The Rise of Online Grocery

Online grocery has been a rising star within e-commerce industry in the past year. It is one of the most underpenetrated categories with big market potential or TAM (Total Addressable Market) and thus many online players have joined the game to gain market shares with various business models and strategies. It is still too early to say who will be the winner in this segment as e-grocery development is still in early stage with uncertainties around regulatory environment. We think e-grocery is more fragmented compared to other goods and categories as there are more players with various business models in this segment. It will be an interesting and important area to watch out for in the coming years.

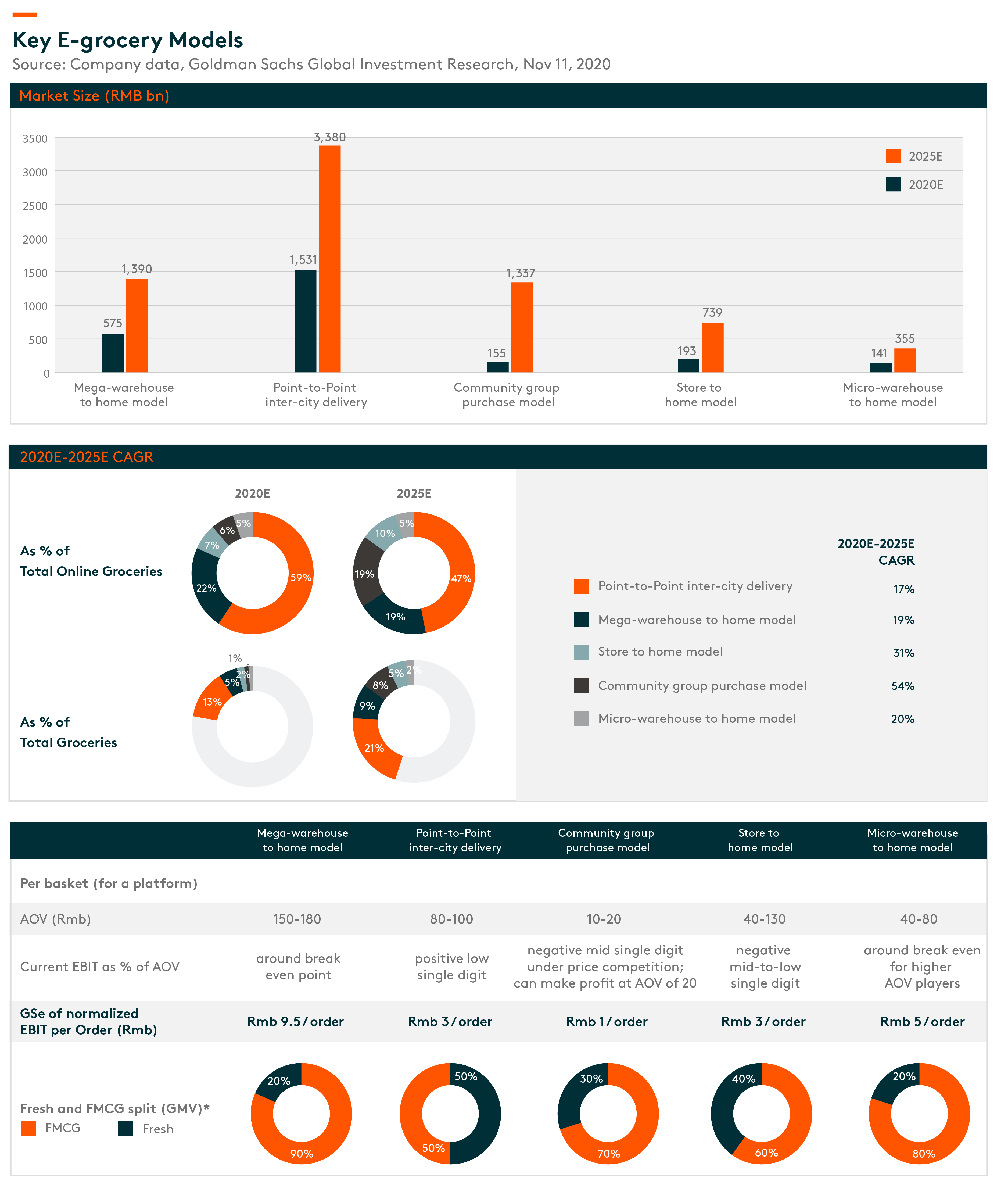

Grocery is an Rmb 11trillion market largely comprised of fresh food (Rmb 5trillion) and FMCG (Fast Moving Consumer Goods, Rmb 6trillon). (11 November 2020, Goldman Sachs) In 2019, less than 10% and 20% has been spent online for fresh and FMCG respectively, according to Goldman Sachs. Overall, online grocery penetration was estimated to be 15% compared to that of 23% for overall online retail and over 50% for categories like apparel and home appliances in 2019. (21 July 2020 Bernstein) However, grocery is one of the key categories accounting for more than a third of the total consumption in China. Thus, it is natural for all e-commerce players to be keen to gain shares in this segment.

Why is e-grocery so underpenetrated in China? First, it is a very fragmented industry with Sun Art as the largest hypermarket in China which only accounts for single digit shares. (Source: Euromonitor, as of 2019) This is because food is a very regional product with local delicacy and tastes and thus supply chain has been developed on a regional basis. Second, logistics and infrastructure has not been developed much with cold chain penetration being only 30% compared to that of over 95% in the US. (11 November 2020, Goldman Sachs) Third, grocery is a low margin business by nature. Particularly, fresh food is a traffic driver but very low margin business whether it’s online or offline. Thus, unit economics is not good even online for this segment while supply chain cost is high. Having said that, more consumers that used to prefer buying fresh from offline were forced to try online grocery due to the COVID-19 and their shopping habits have changed dramatically.

What has the pandemic changed in e-grocery industry? From demand perspective, consumers were initially forced to try online grocery during the lockdown, but we expect this has changed consumer habit as many have found the convenience of ordering online once they try. From supply perspective, many companies have come up with various strategies and business models to capture this opportunity. This means more investment has been made than ever before in this segment and it is likely to remain this way which will lead to more investments into infrastructure and thus improve overall efficiencies of the supply chain. This will improve unit economics of online groceries, but we believe this alone may not be enough. It is important for companies to cross sell other goods and categories on top of fresh food to be meaningfully profitable.

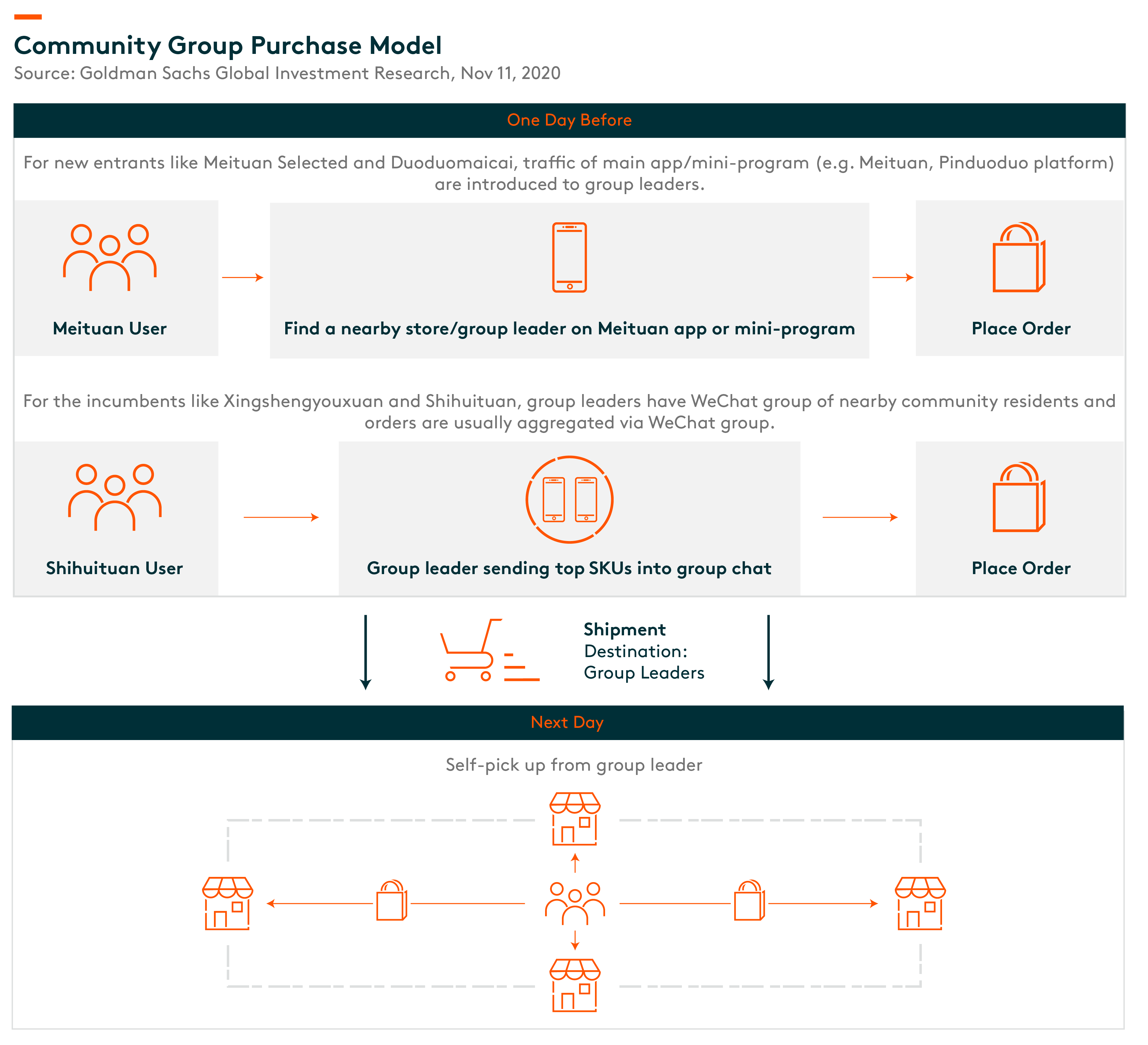

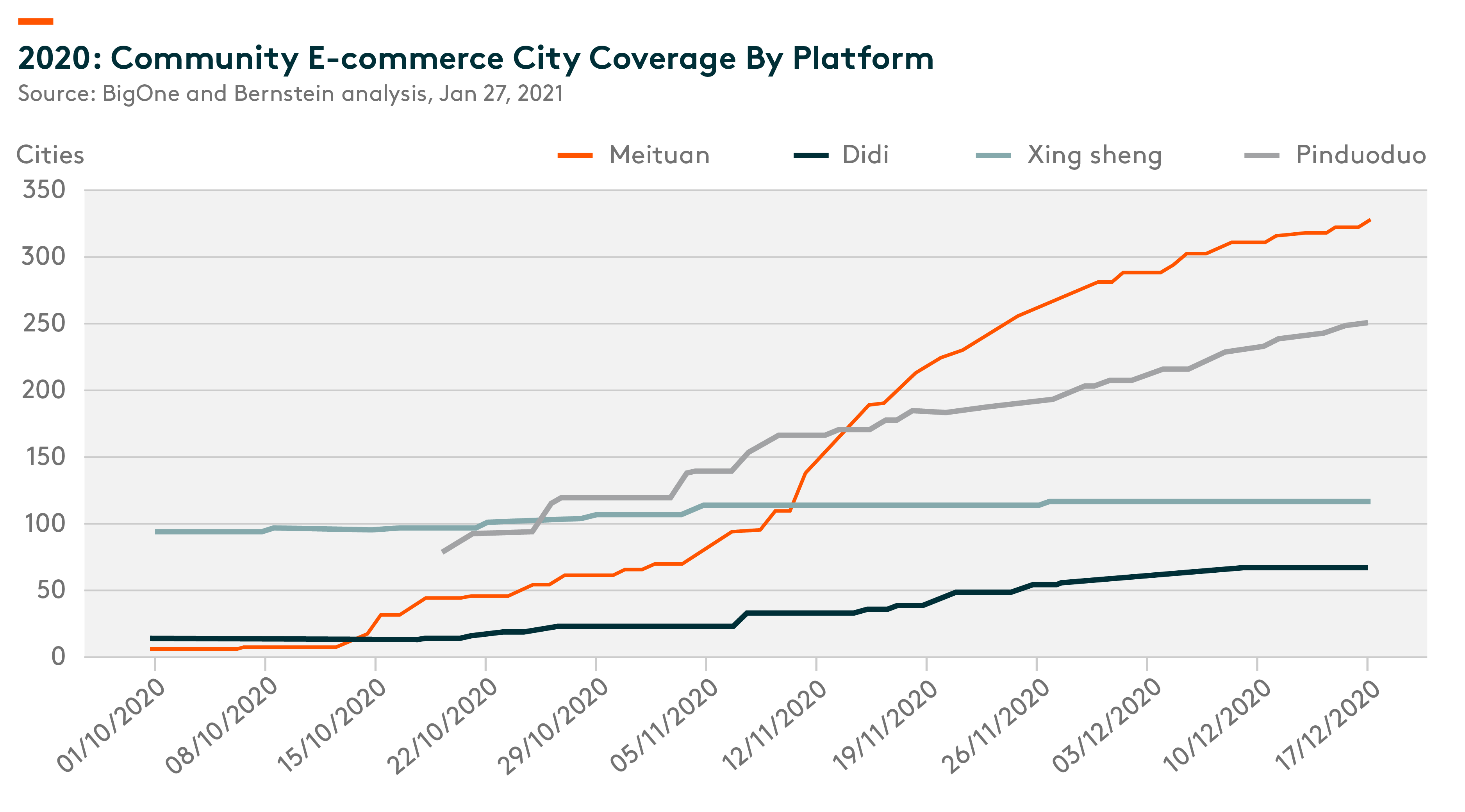

E-grocery players can be classified into three groups. First, platform owners like Alibaba, JD, and Pinduoduo (PDD). Second, offline retailers such as Hema, Sunart, Yonghui etc. Third, emerging players like Meituan, Didi, Xing Sheng You Xuan, Shi Hui Tuan etc. for community group buying and smaller players like Miss Fresh, Ding Dong Mai Cai etc. for Font Distribution Center (FDC) or Micro warehouse to home model. Platform owners play the key role in e-grocery with Alibaba, JD, and PDD taking 75% online grocery shares by GMV (Gross Merchandise Value) in 2020E. (11 November 2020, Goldman Sachs) In terms of business model, typical 1P (first party) (Tmall supermarket, JD supermarket) and 3P (third party) (Taobao, JD, PDD, Douyin, Kuaishou) e-commerce model contributed over 80% of total online groceries sales in 2020. (11 November 2020, Goldman Sachs) We think this will remain a large part of online grocery considering their already established ability to cross sell other categories on top of fresh food. However, their shares will also depend on how fast community group purchase grows which has been a dark horse in e-grocery. Community group purchase has been the fastest growing and the most competitive segment with Meituan and Didi joining the game on top of existing players like Alibaba, PDD and private incumbents like Xingshengyouxuan and Shihuituan. According to Goldman Sachs, community group purchase may take 19% of e-grocery shares by 2025E compared to that of 6% in 2020E. This is a unique business model developed in China where consumers order grocery through their local group leaders via Wechat usually the night before and self-pick up the next day at designated stores. Meituan, PDD, and Didi have been particularly aggressive in the past several months providing subsidies to gain market shares within this segment. Meituan and PDD have moved the fastest in terms of geographical expansion and both are very committed to this opportunity. Meituan management shared in its Third Quarter Financial Year 2020 earnings call that Meituan Select is the company’s top priority. The company can leverage its know-how from its food delivery business as there are similarities between the two businesses in terms of dealing with offline partners and routing of complex on the ground fulfillment/delivery etc. PDD also has its own advantage as the company has already built supply chain particularly in sourcing agricultural products for many years for its e-commerce platform business which they can leverage into community group purchase business as well. Meituan and PDD seem to be the most formidable players in community group purchase segment so far. It will be interesting to see how much share these players or community group purchase can gain in online grocery segment in the next 2-3 years while they will also have to prove this can be profitable and thus it is a sustainable business model.

We believe online grocery will be one of the fastest growing segments in the next few years within e-commerce industry. There is still uncertainty around regulatory environment with anti-trust regulation as well as regulation on community group purchase which may affect competitive dynamics in the industry. Yet, we believe this segment will continue to grow with various business models and companies in a healthier competitive environment.