LED Market: Recent Developments and Trends

In this article, we will give a brief introduction to the light-emitting diode (LED) industry and go through the current competitive landscape of the industry.

LED Technology Overview

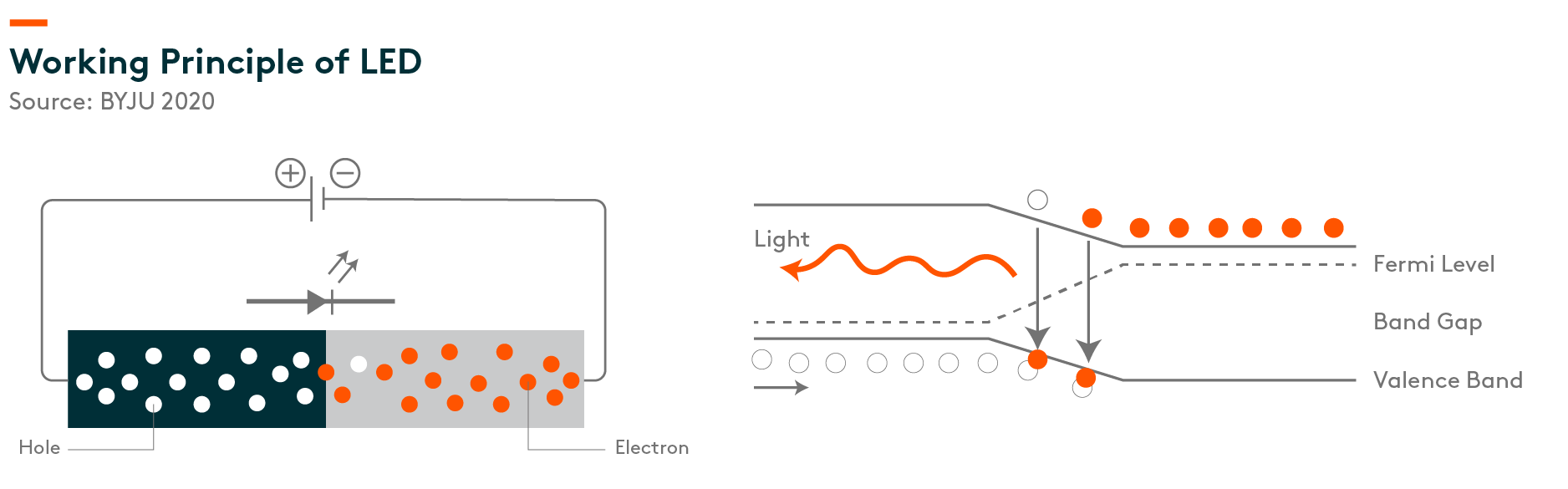

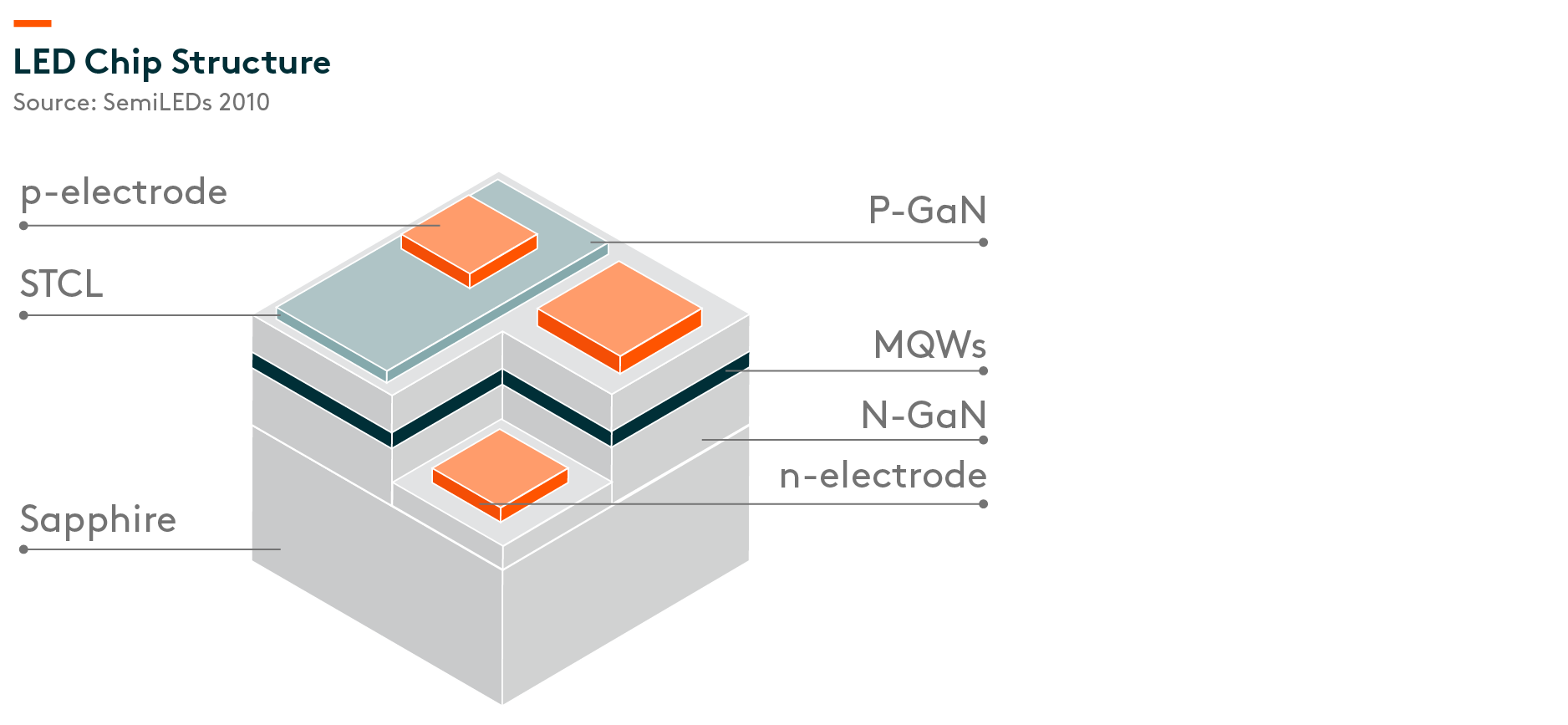

Light-emitting diode (LED) is made from semiconductor materials. The recombination of electrons and electron holes in a semiconductor produces light. Based on the semiconductor material used and the amount of doping, an LED will emit a colored light at a particular spectral wavelength. The advantages of LEDs include high energy efficiency, small size, short response time, high reliability, and long lifetime, etc.

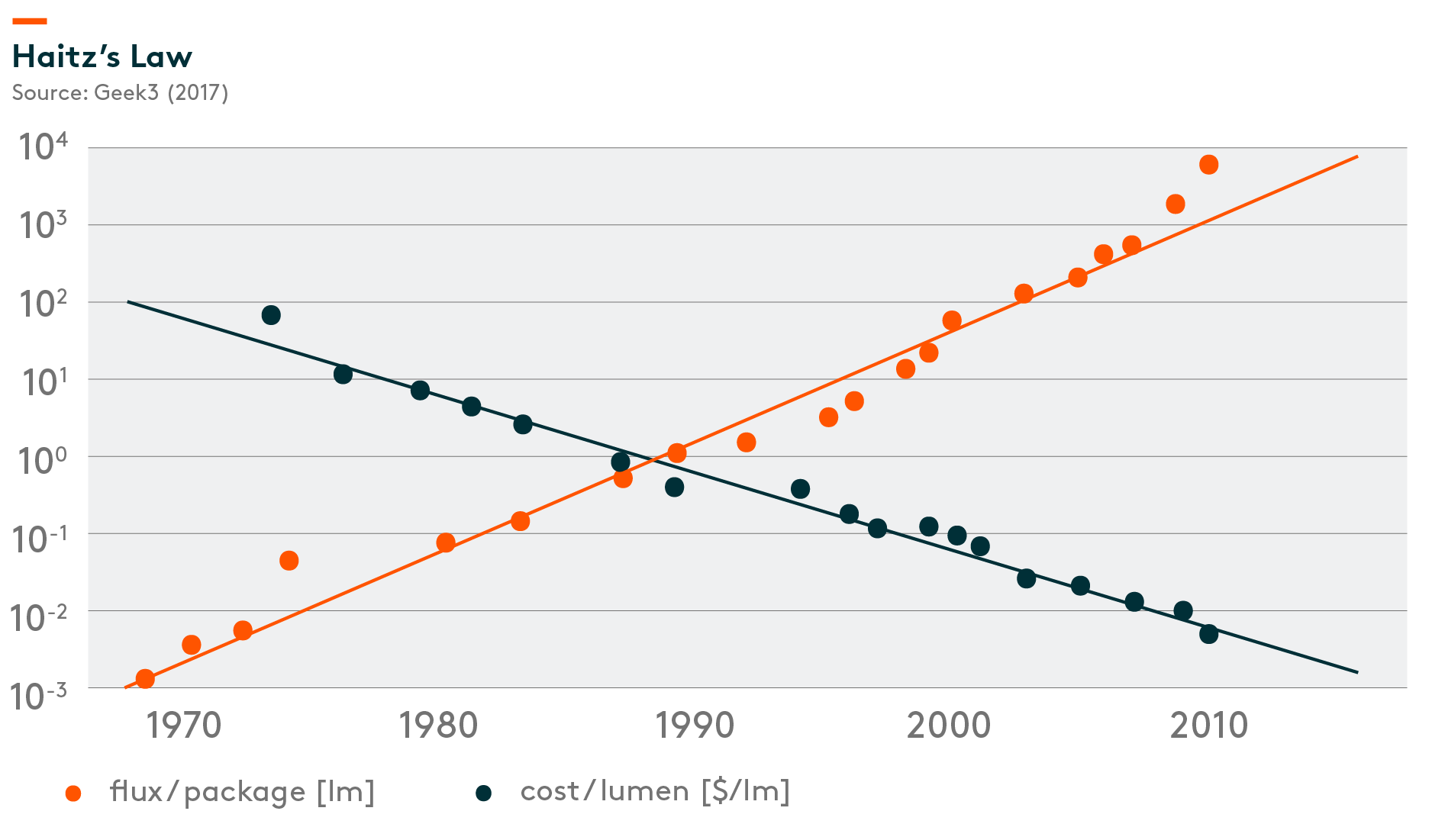

The improvement of LED technology can be summarised with Haitz law, which states that in every decade, the cost per lumen (unit of useful light emitted) falls by a factor of 10, while the amount of light generated per LED package increases by a factor of 20, for a given wavelength of light. This means lighting efficiency has been improving rapidly, and cost has also been dropping significantly.

Main applications of LEDs include display backlight, display, and lighting. The improvement in LED technology and reduction in cost enables technology penetration to increase in the respective application verticals. Innovation in miniaturisation of LED chips such as mini LED and micro-LED will drive the industry forward in the next decade.

Below illustrates the applications of LED and their details:

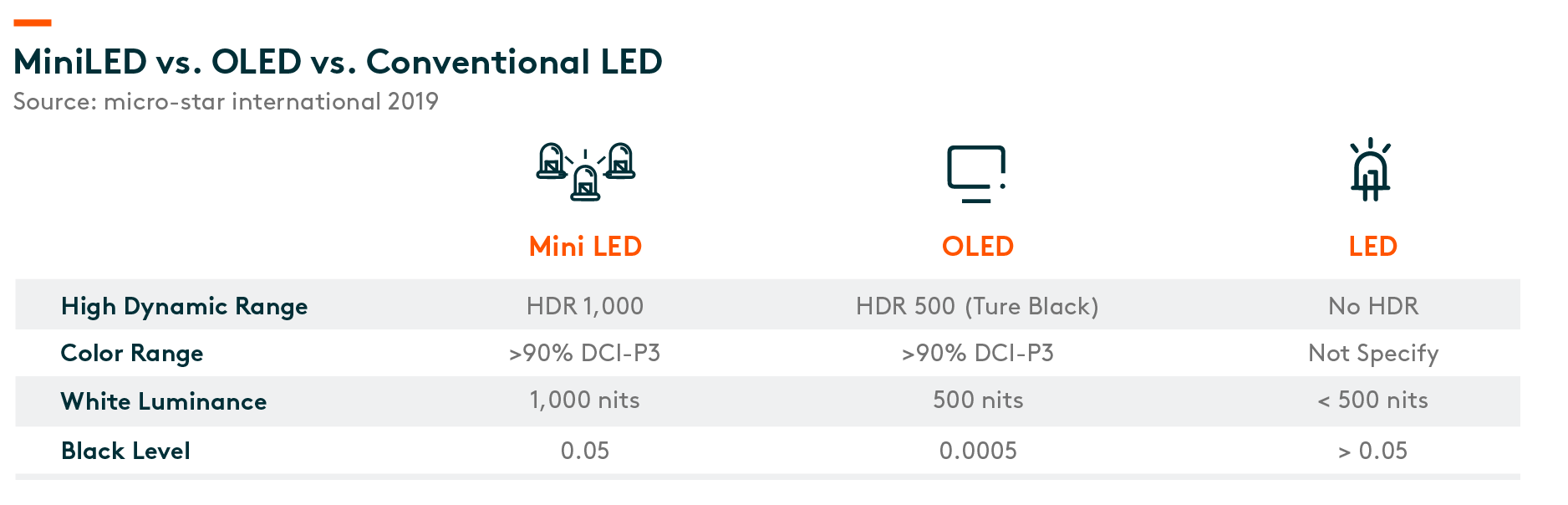

- Display: The two main ways to adopt LED in display are to use it as a backlight or as part of the display. The majority of Liquid Crystal Display (LCD), for example, use LED as backlight. This is one of the earliest applications of LED. Evolution of this technology is to use mini LED as the backlight. By increasing the density of the backlight, LCD can achieve similar performance to OLED (Organic light-emitting diode) as the adjustment of brightness is possible down to local level (traditional backlight simply provides uniform brightness), which creates higher contrast/dynamic range. Given the significant price gap between LCD and OLED, display with mini LED fills the gap in between. Apple is currently the main driver of mini LED backlight adoption. The company is expected to launch three products adopting mini LED backlight, including the iPad Pro iMac and Macbook Pro in 2021.Companies also build displays with LED directly. Currently, LED is mainly used for outdoor displayer large indoor displays where resolution requirement is relatively low. However, with the development of mini LED and micro-LED technology, companies are building higher resolution display with LED chips directly.

- Lighting: LEDs are used in various lighting applications, including auto, home, industrial, infrastructure, and more. The energy efficiency, stability, and long lifetime of LEDs present a clear advantage over conventional lighting technologies like fluorescent, quartz halogen, incandescent, etc.

China becomes a dominant supplier of LED chips globally

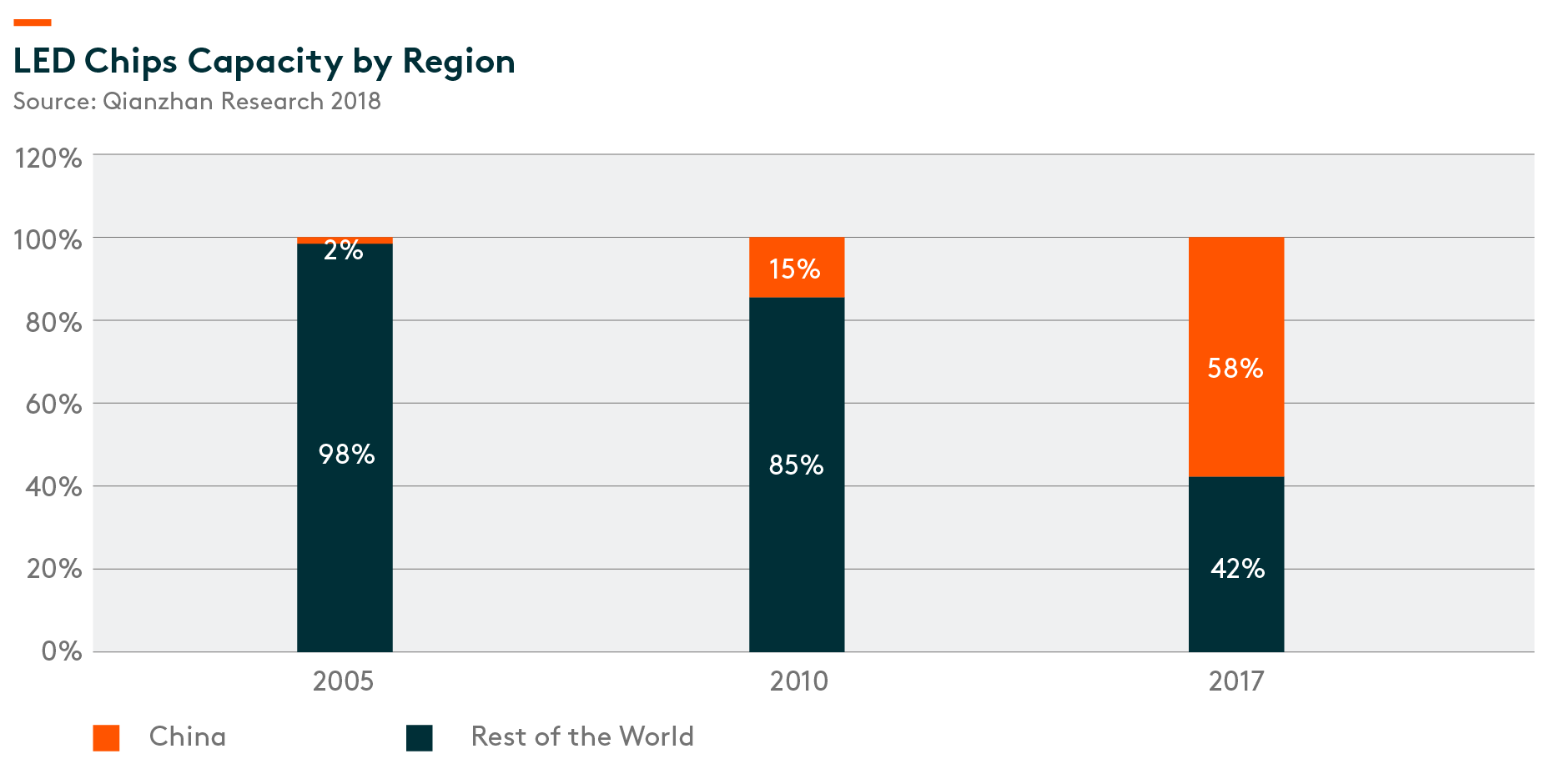

The LED industry used to be dominated by Japanese, Korean, and Taiwanese companies. In 2005, China only accounted for around 2% of global LED chip capacity. It all changed in 2009 when the Chinese government began to provide high subsidies (around 60%) for the purchase of MOCVD (Metal-Organic Chemical Vapour Deposition) (key manufacturing equipment for LED chip) by LED chip manufacturers. The rapid growth of the domestic industry has put significant pressure on its foreign competitors in terms of price and margin. The price of LED chips dropped over 90% from 2010 to 2020.1 The market share of Chinese companies in LED chips climbed to 58% in 2017 from 2% in 2005.2

We estimate mainland China now has over 70% of global LED chip capacity. Sanan optoelectronics has the largest LED chip capacity globally at around 35%-40%.3 Epistar has around 15% of global capacity, followed by HC SemiTek and Aucksun.4

Related ETF

Global X China Semiconductor ETF enables investors to access high growth potential through companies critical to the development of semiconductors in China.

Other Key Features:

- Targeted Exposure: The fund delivers targeted exposure to an emerging theme and industry.

- ETF Efficiency: In a single trade, the fund delivers access to dozens of companies with high exposure to the semiconductor theme in China.

Please click here for more information on the Global X China Semiconductor ETF.