From Innovation to Revolution: Chinese Biotech Industry

Biotechnology is the use of biological materials, such as proteins, antibodies, genes, and cells, to develop new drugs and treatments. It is not a new concept. Humans have been harnessing the power of organisms for thousands of years – bread making is an early example.

That said, recent advances have revolutionized our understanding of biosciences and may present the first legitimate possibility of treating illnesses once thought incurable or fatal.

Significant Impacts

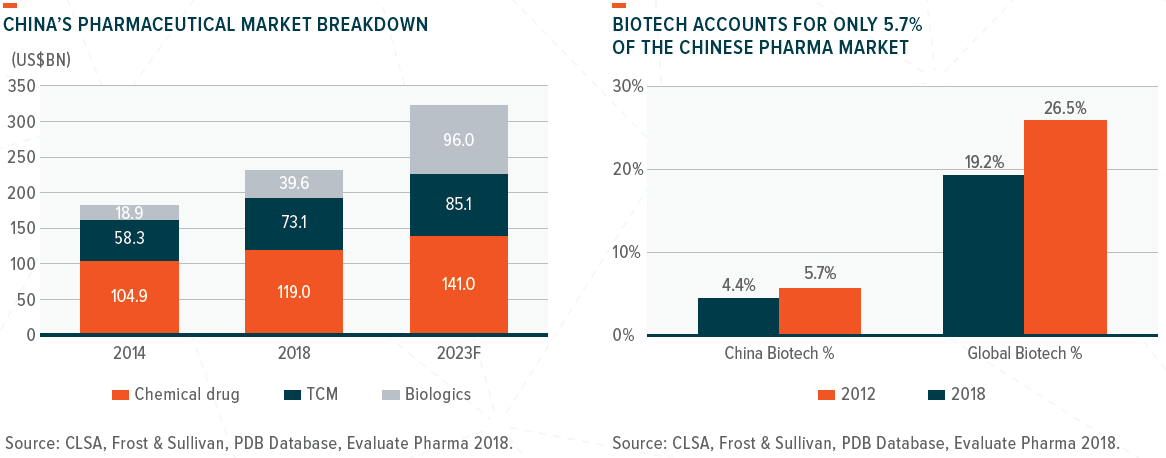

Healthcare in China remains relatively underpenetrated – more specifically, biotech-driven treatments account for only 12% of the country’s total drug market. However, this is set to change with the emergence of several key catalysts, which will have a significant impact on both companies and investors over the next decade. Most notably, these include the NMPA’s attempt to build a more transparent and efficient drug-approval system based on global standards. We also have seen shifts in the prescription mix that have an increasing focus on clinical benefits and the establishment of a more focused and dynamic, single-payer system.

This transformation is expected to alter the industry’s strategic focus from the development of generic drugs to the creation of new products. In turn, it will drive consolidation among generic manufacturers and see the emergence of a new breed of innovative biotech companies that will potentially provide significant economic returns on investment. Further details on these drivers are noted below.

A Gradual Evolution

There are risks, of course. The biotech sector requires substantial investment in research and development (“R&D”), and this outlay is not guaranteed to result in commercially successful products. But a significant number of Chinese biotech companies are seeking to mitigate R&D risks by developing so-called “me-too drugs,” which are closely related to existing products. Another low R&D risks’ development, named “me-better offerings,” could improve the existing treatments but can’t be classified as ‘new.’ As a result, we see cancer and other therapeutic categories, in particular, being driven into a more crowded space. However, we do expect a gradual evolution of R&D strategies into a best-in-class or first-in-class approach. This move will is expected to heighten innovation, ranging from contracted research and drug discovery to drug manufacturing in the Chinese market.

We should also point out that a biotech firm’s prospects are also vulnerable to changes in the regulatory environment, intensifying competition, and a rapidly evolving nature in technological progress. Intellectual property remains a concern, too. Furthermore, many companies are dependent on the ability to use and enforce intellectual property rights and patents, even if effective, the expiry of rights and licenses can have adverse financial consequences on those businesses.

What is Underpinning China’s Biotech Industry?

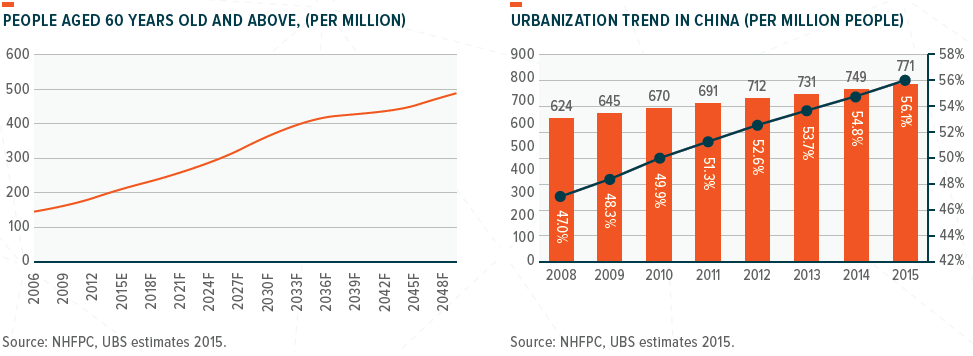

The aging society and the urbanization shift will continuously drive the demand for quality healthcare in China. There are over 400 million people who will be 60 years or above by 2030. Also, over 56% of the population now live in towns and cities. It is also worth noting that people’s ability to fund their healthcare costs is also increasing with the average disposable income of residents rising to Rmb28,228 in 2018 (or US$4,097) – this is 54% higher than five years earlier.

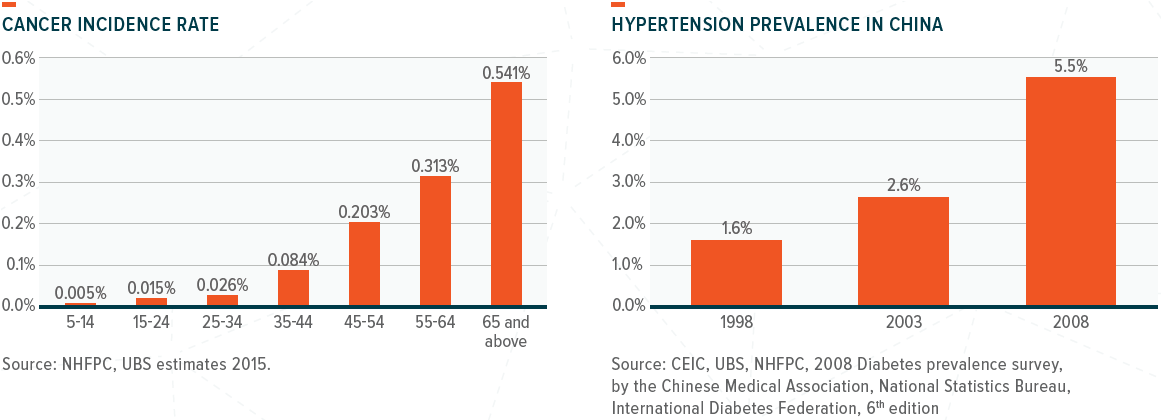

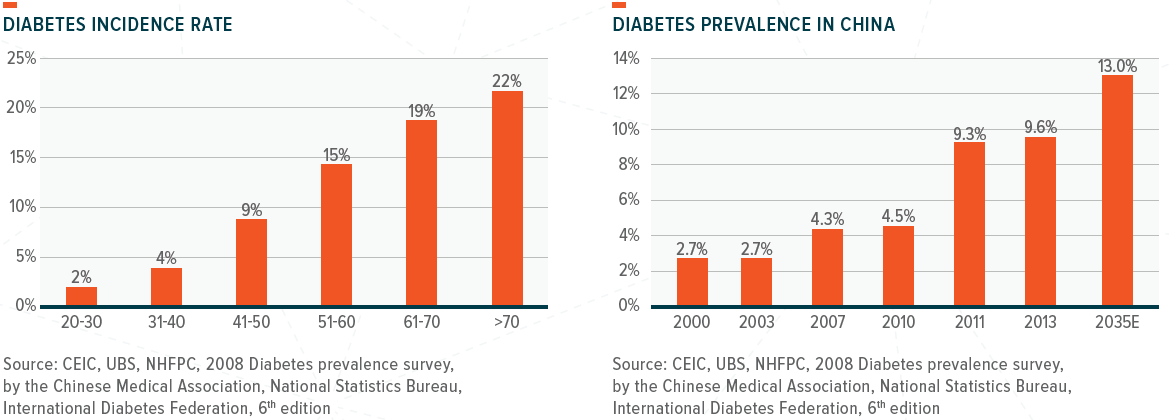

From a health perspective, the charts below show that cancer incidence and diabetes prevalence will increase significantly beyond the ages of 50–60.

According to market analyst Frost & Sullivan, China’s biotech market is expected to grow to US$96 billion by 2023, from US$40 billion in 2018, that is an annual growth rate of 19%.

Several themes will drive the expansion of China’s biotech industry:

- ACCESSIBILITY: As of April 2019, China’s drug authority, the NMPA, licensed 33 antibody/fusion protein-based therapies, including 21 imported and 12 domestic drugs. This number is still below US levels, where approximately 100 treatments received the green light but is still a notable improvement on the 21 approvals as of May 2018.

- REIMBURSEMENT COVERAGE IS IMPROVING: From 2015–2017, a total of 18 monoclonal antibodies (mAbs) and fusion proteins were added to the National Reimbursement Drug List (NRDL) for the first time. The NRDL is a catalog of treatments that qualify for reimbursement under government-supported health insurance schemes. In 2018, the NMPA then only included 17 anti-cancer drugs in the NRDL. We expect this trend to continue as more therapies to gain approval.

- A SHIFT IN THE PRESCRIPTION MIX: The growth of medical insurance funds is strictly controlled. But government initiatives aimed at reducing the amount spent on drugs that lack substantial evidence of clinical benefits, such as traditional Chinese medicine, which still accounts for 30% of total market share. These initiatives could create room for medical insurance spending on new therapies.

- THE GROWING ADOPTION OF PHARMACOECONOMICS: The government agencies that administer the medical insurance system in China have begun to recognize the value of pharmacoeconomics (an all-round measure of drug efficiency) in assessing the cost-benefits of new therapies. Since 2017, the Ministry of Human Resources and Social Security of the People’s Republic of China (MOHRSS) has included pharmacoeconomic factors when deciding whether to bring the patent drugs into the NRDL catalog.

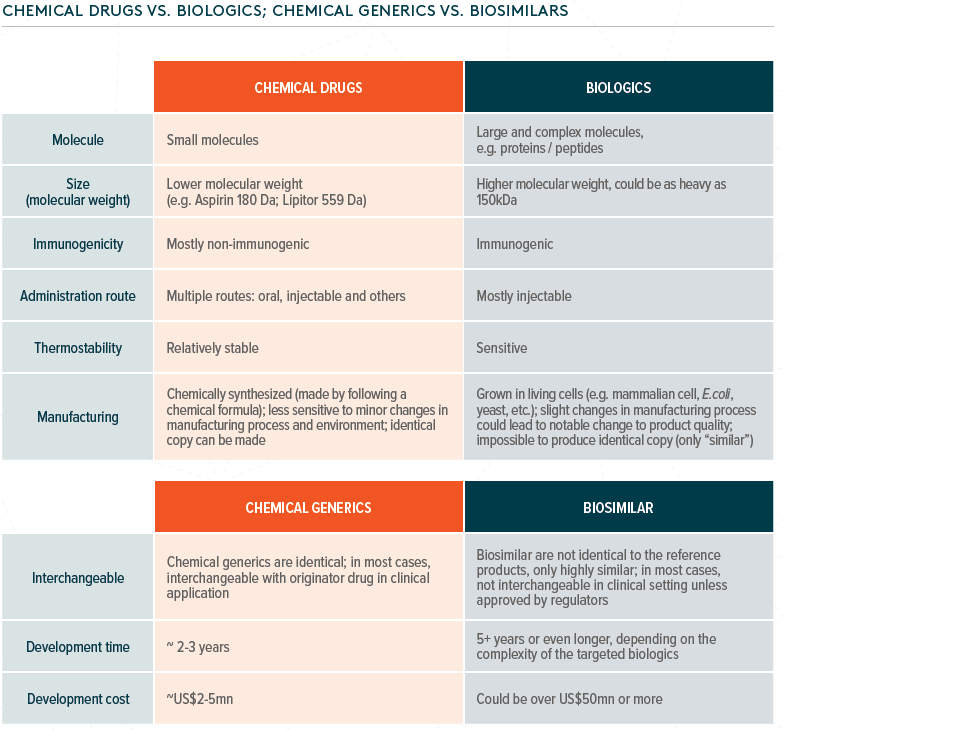

- BIOSIMILARS DEVELOPMENT: Biosimilars, which are drugs closely related to existing treatments, are currently being developed by Chinese companies. These are potentially cheaper alternatives to those already produced by the big multinationals. China approved its first biosimilar (Henlius’ Rituximab for the treatment of non-Hodgkin lymphoma) in February 2019. More launches will potentially follow this in the second half of 2019 and throughout 2020, as over 150 biosimilar candidates are at different stages of clinical development.

Expanding Sales

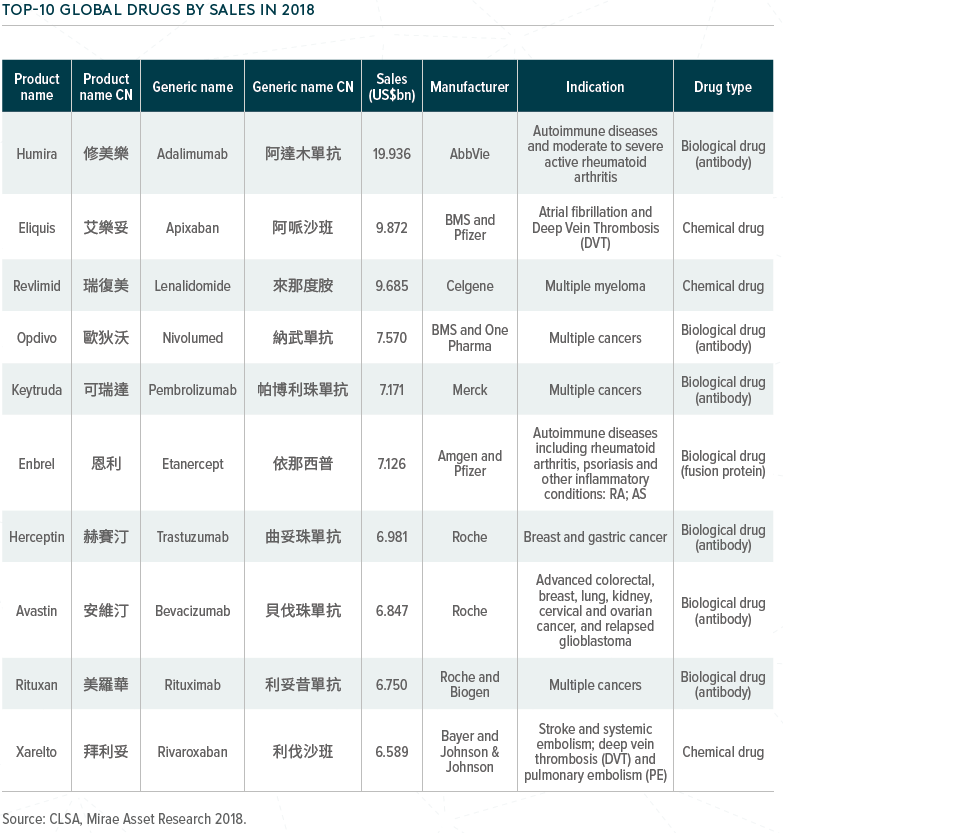

Globally, biotech-driven drugs have seen significant growth over the past few decades. In 2018, seven out of the top ten bestselling products globally were biologics, including two innovative PD-1 treatments.

Improving Access to Capital

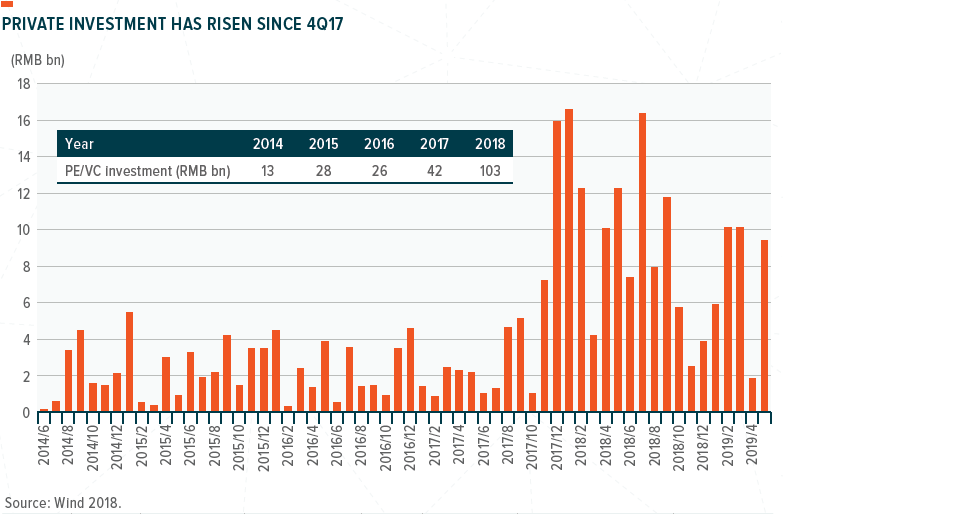

Key recent developments include (1) Changes to the Stock Exchange of Hong Kong’s listing rules for pre-revenue biotech companies and the China Securities Regulatory Commission’s new fast-track approval for the listing of high-tech ‘unicorns,’ and 2) Growing private equity and venture capital investment in biotech.

In the future?

Over the longer term, China’s biotech business has the potential to go global, either by out-licensing to overseas markets or by developing assets in the US, EU and elsewhere. According to industry analyst China Bio, Chinese biotech companies made 164 cross-border licensing deals in 2018, more than double the 2013 figure. Furthermore, China is pursuing trials for one-quarter of its innovative assets overseas.

The country’s increasing dominance is also reflected in the number of biotechnology patents granted, rising from more than 1,000 (12% of the global total) in 2006 to more than 6,000 (27% of the world total) in 2016. In 2012, China even surpassed the US in this area.

Finally, China’s government has listed biotechnology as one of the ten critical sectors for development under its “Made in China 2025” industrial strategy. The authorities are improving the country’s regulatory framework, reforming the drug-approval process, and providing more explicit guidance for biosimilar developers.

Fact check: what are biologic drugs?

Biological drugs refer to products derived from living organisms or parts of living organisms, such as proteins, vaccines, blood components, and genes. A biologic drug differs from small single-molecule medicines – it is larger in terms of molecule size and more complex in structure.

This type of treatment has become more popular as new therapies in various diseases, such as cancer, autoimmune diseases, and endocrine system diseases, have been developed. The manufacture of biologics is very different from chemical manufacturing: microorganisms are normally used, so a suitable environment for growing these is essential.

Click here to download the full report.

Related ETFs