“Guochao” – The Rise of Homegrown Chinese Labels

“Guo” stands for country, and “Chao” stands for Chao Liu, which in mandarin means fashionable.

Guochao has become a top buzzword ever since China’s domestic sportswear brand Li-Ning’s debut at New York Fashion Week in 2018, turned out to be a huge success. Its “WuDao” (悟道) collection embedded with traditional Chinese culture, its clothes in red and yellow which represent the colors of China’s national flag, and the four big Chinese characters “China Li-Ning” (中國李寧) right in the middle at the front are believed to be a symbol of cultural confidence which has its roots in China’s rapid rise in the past few decades.

With Li-Ning’s brand image and awareness enhanced in the global market, the trend to embrace domestic brands has also been spreading quickly to various sectors and products, such as mobile phones (Xiaomi, Huawei, Oppo), home appliances (Midea, Gree), apparel (Bosideng, Erdos), food (White Rabbit Candy), cosmetics (Proya, Shanghai Jahwa), etc.

National Pride and Cultural Confidence

“Guochao” followers, mainly Millennials and Generation Z, have strong and genuine confidence in their national identity and traditional culture. They have grown up in an era when China has been catching up quickly with its western peers. The economic growth miracle has made it the world’s second-largest economy.

Chinese new generation does not think the quality or appearance of domestic brands is inferior to foreign brands, which used to have a halo effect as a group as they were once in short supply and of better quality decades ago when China kept its door closed. In fact, some Chinese brands have made much progress in upgrading their product series in terms of aesthetics, innovation, and technology, while keeping prices competitive compared to their foreign peers. These renewed Chinese brands can either arouse “Guochao” fans’ emotional resonance or involve trendy technology that enhances the “cool factor.” They are quick to respond to consumers’ needs and make great efforts to shorten the production cycle to create fresh new products that reflect the market demand.

Statistics jointly released by Baidu and the Research Institute of People.cn show that the percentage of keyword searches for Chinese brands surged to 70% among all the searches, much higher than the 38% seen in 2009. The tags related to Chinese brands have also changed from “OEM” and “low quality” in 2009 to “core technology” and “independent R&D” in 2019.

Towards a Consumer-led Economy

This “Guochao” trend is taking place on the backdrop of China’s economic transformation from an economy led by exports and investment to one driven by consumption. China has rolled out series measures in the past decade to impel this shift, which has indeed born fruit. Meanwhile, the continually increasing disposable income means that Chinese people now have much stronger purchasing power. China’s Gross Domestic Product (GDP) has expanded more than 50-fold since its milestone reform in 1978, and the disposable income per capita has also increased more than 20 times.

In addition, from a global perspective, the escalating trade and political tensions between China and the U.S. recently have also accelerated the pace of domestic substitution as strengthening patriotism pushes more Chinese people to buy domestic brands. Nielsen’s study for the second quarter of 2019 showed that 68% of Chinese consumers preferred home-grown brands, as nationalist sentiment had been rising. Consumers in the first and second-tier cities have a stronger willingness to buy domestic brands, among which 67% choose domestic brands because they are passionate about Chinese traditional culture and symbols.

China’s younger generation has grown up amid the country’s rising influence globally as well as a digital world that makes domestic brands’ penetration much easier and faster. The booming e-commerce platforms in China play an important role during the process. Key Opinion Leaders (KOLs) rely on Alibaba’s Taobao platform, TikTok and Kuaishou to do live streaming or make short videos to sell products, and the Gross Merchandise Volume (GMV) that some top KOLs can generate is astonishing. According to the China Internet Network Information Center, China’s online shopping user penetration climbed to 78.6% by March 2020. Compared to the traditional marketing and sales practice, these innovative ways of communication, thanks to the evolution of technology, are more interactive and can thus improve consumer experience and increase user stickiness.

Chinese consumers have been shifting from being infatuated with only foreign brands to paying attention to detail, cost performance, as well as culture and technology elements, as the younger generation has gradually become the main force of consumption. We believe this “Guochao” trend is likely to last as long as domestic brands continue to adapt to consumer needs quickly and improve their products accordingly. The new generation prefers encompassing quality, aesthetics, embedding Chinese culture and high-tech elements, and telling their brand stories via the ever-changing channels. Foreign brands, in the meantime, will also need to understand Chinese consumers better and be more innovative to attract the younger generation’s attention after the low-hanging fruit has been picked.

Guochao Trend #1 – Athleisure: Trendy, Cool, and Stylish

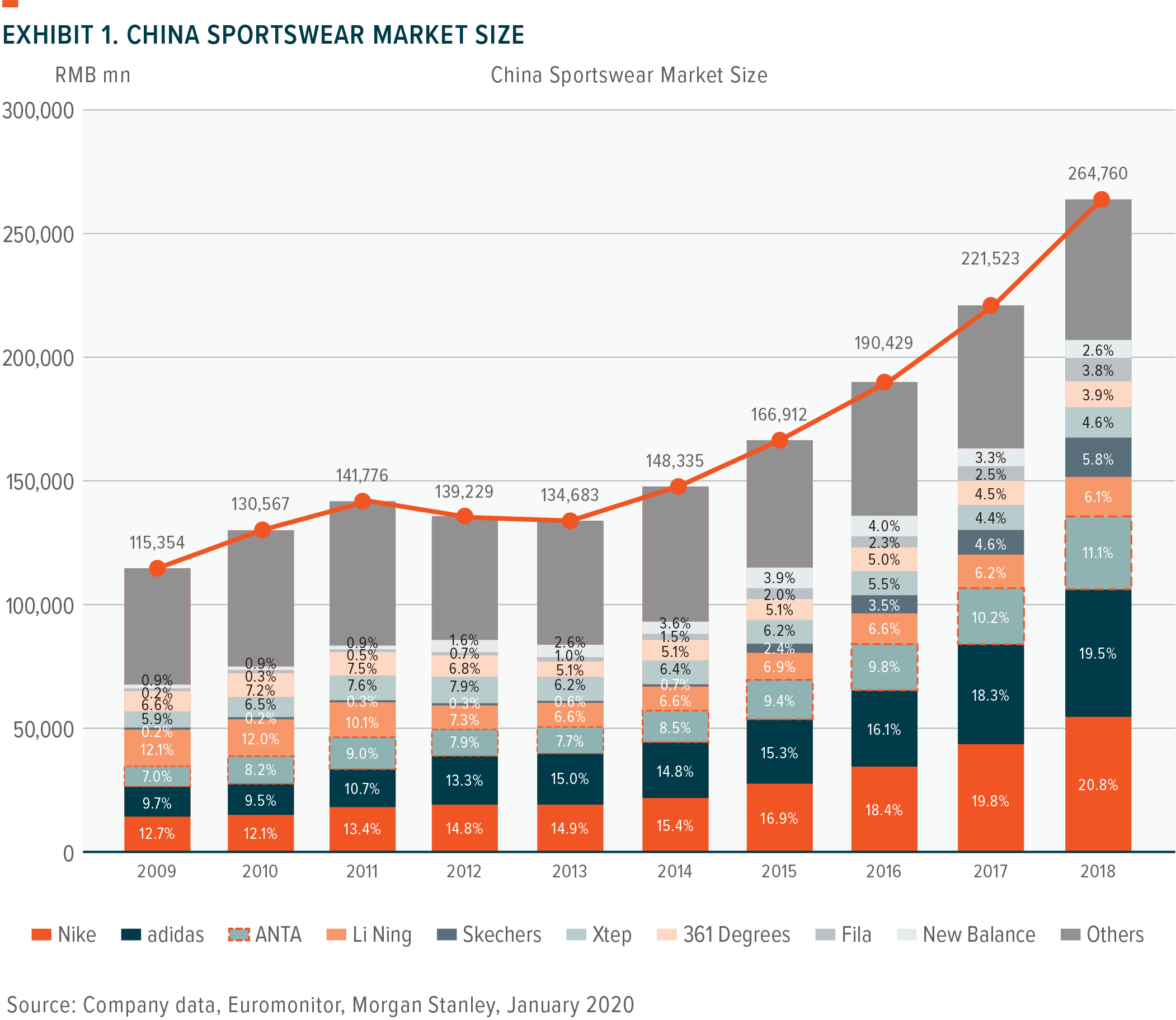

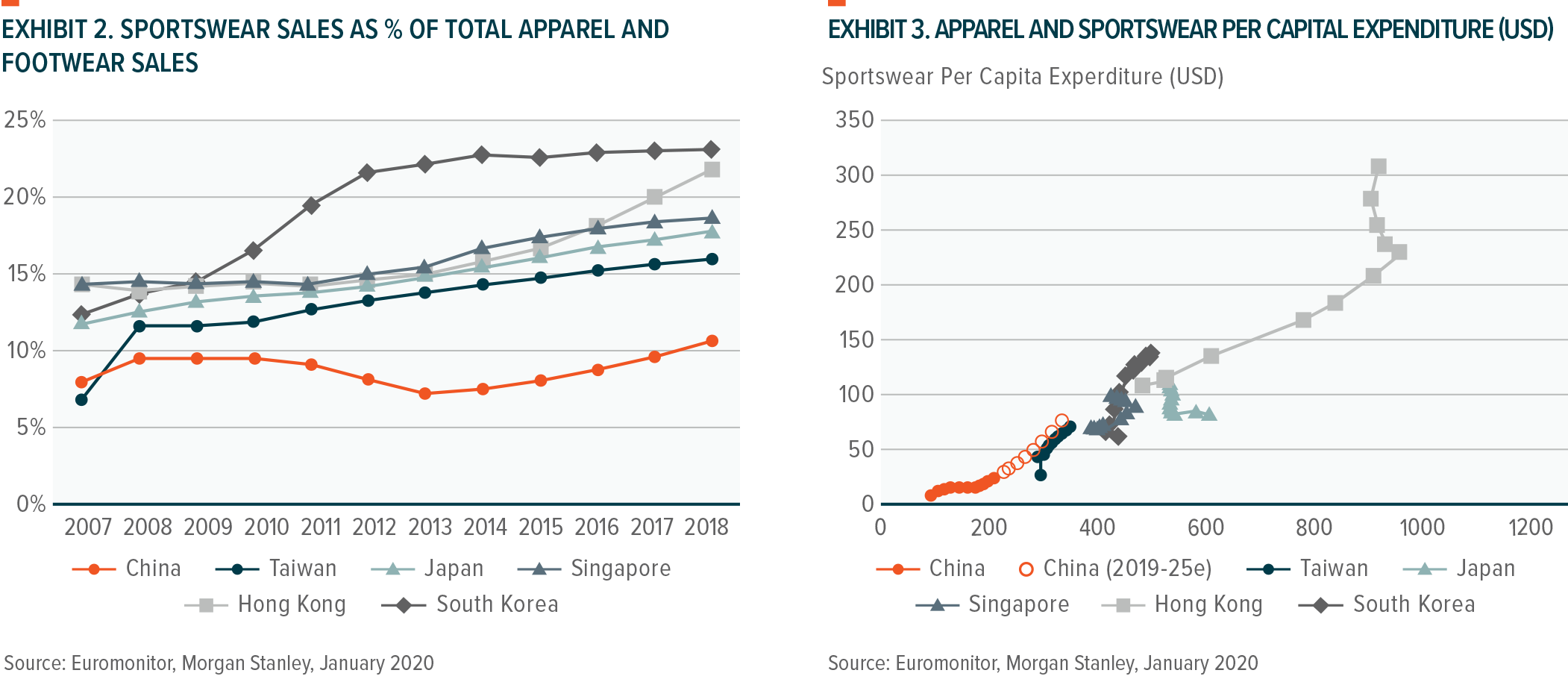

Sportswear is the strongest of Guochao’s sub-industry within the consumer discretionary sector. Robust growth in the sportswear industry is not just a Chinese consumer trend but more of a global phenomenon. With increasing health awareness, many consumers do care more about what they eat and participate in more sports activities than in the past. For instance, the marathon gained popularity in China with a record high of 1,581 marathons in 2018, up 43.46% from 1,102 in 2017. The total number of participants rose by 17.07% YoY to 5.83mn, according to the Chinese Athletics Association (CAA). More importantly, striving for a healthy life has become the key trend of urban lifestyle, which has benefited the sportswear industry. Consumers, especially the younger generation, want to look healthy and energetic, and thus the demand for sportswear has expanded beyond functional shoes and apparel to casual urban lifestyle outfits. For example, girls wear lululemon yoga pants even when they are not doing yoga or any other workout just as a fashion trend. Similarly, it has been trendier to wear apple watches rather than any luxury brand watches among many consumers.

Casual wear has become a fashion trend that has driven the sportswear industry to take shares from the apparel industry. Young consumers, particularly those millennials and generation Z, have been dressing more casually than their parent generation. It was not common for older generations to not shave or to dress casually to work. Nevertheless, today, many tend to dress more casually to work, especially those working for tech companies that are more relaxed on these compared to traditional industries. Most luxury brands have sports shoes, and it is a big hit to many sportswear brands, which has also expanded from functional wear to casual wear. As a result, this may be one of the success factors of Fila in China.

China has been supportive of the sports industry and catching up in recent years, even though it was underinvested in the past. For example, the total number of sports facilities in China increased from 850,000 in 2004 to 1.96mn in 2017, growing approximately 6% YoY every year. We believe the Chinese government will continue to encourage the sports industry going forward, and there are many reasons behind it. For instance, China is aging fast with declining birth rates, and thus healthcare spending will increase. If more people stay healthy via participating in sports activities, it will reduce the social burden. Also, many teenagers spend too much time playing online games, which has become a social issue, and there have been regulations introduced to reduce time kids spend on online games. Encouraging more young Chinese to participate in various sports games can be a better solution to such issues. Meanwhile, there will be the Tokyo Olympics in 2021, followed by the Beijing Winter Olympics in 2022, which will also be supportive of the sportswear industry in China in the near term.

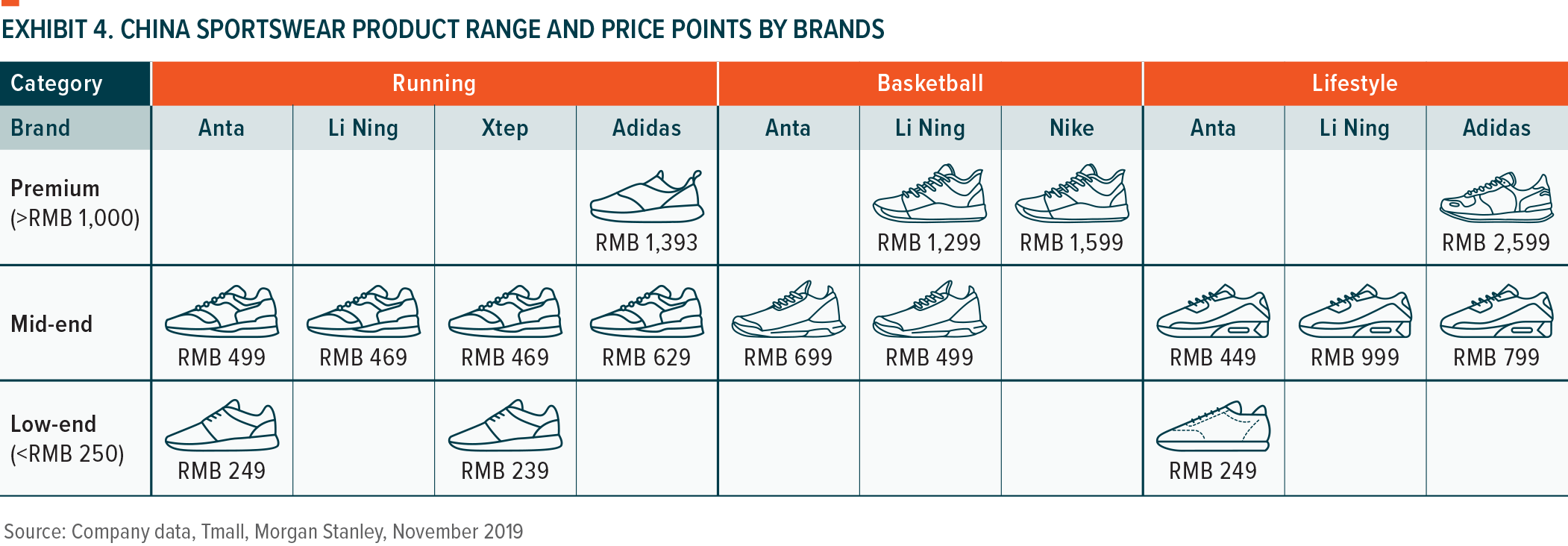

One interesting trend we see in the sportswear industry in China is the rising demand for local brands. Young Chinese consumers have grown up amid strong economic growth in China, and thus they are very proud of their country, i.e., strong nationalism. Parent generation preferred foreign brands and products over local brands in the past with a general perception that foreign products have better quality. This perception has changed that today many young consumers feel no difference whether it is local or foreign, and prefer whichever brand with a more trendy style. One good example is China Li-Ning, a high-end brand that Li-Ning launched in 2019. Anta and Li-Ning products tend to be sold 40-50% cheaper than those of Nike and Adidas. Some product lines of China Li-Ning were launched at similar price points to those foreign brands, but still, they have been prevalent among many Chinese. We expect strong industry growth will continue to benefit both global brands as well as local brands, but we expect to see stronger growth in domestic brands amid U.S. and China trade war.

Guochao Trend #2 – Riding the Mobile Wave in China

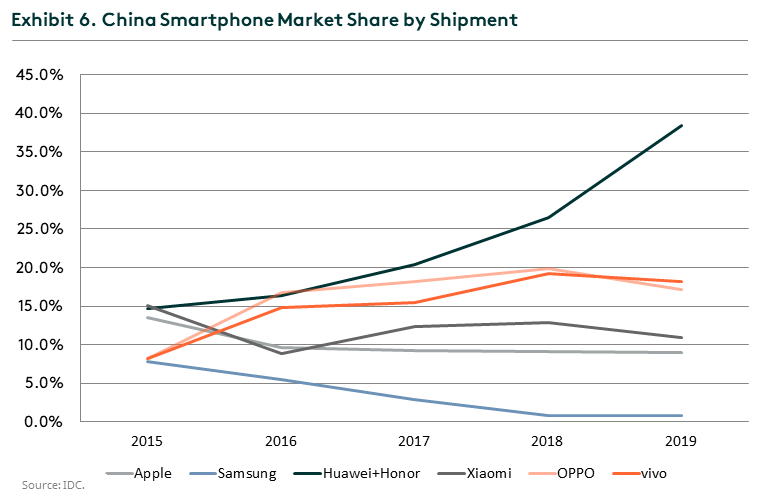

Foreign smartphone brands have been under pressure since the 4G era. In 2015 Apple’s market share was 13.6% while Samsung had 7.8% market share in China. By 2019 Samsung’s market share had shrunk to 0.8% and Apple at 8.9%. On the other hand, domestic brands gained traction over this period, especially Huawei, after the U.S. began sanction in 2018. Huawei’s market share almost doubled from 2017 to 2019 after the US-China trade war as consumers turned to support the company in light of tough U.S. sanctions. The top 4 Chinese smartphone brands had a combined market share of 46.1% in 2015, and that number climbed to 84.6% in 2019.

We believe the strength of domestic brands across different hardware categories will continue. Besides nationalism, key drivers include the rapidly improving design and specification of hardware products for domestic brands. Pricing is also competitive, especially for the mid-low end segment. Wearables, for example, saw Xiaomi and Huawei on the top 2 spots with a combined market share of 45.5% despite the strength from Apple products, which had a 13.7% market share in 2019. On the smartphone side, the gap between domestic brands and leading foreign brands has been closing in key features and specifications. The camera performance of many domestic brands even exceeded flagship Apple and Samsung phones by Dxomark rankings. Leading brands are moving aggressively into mid-high end markets, launching competitive products ahead of oversea rivals.

Turning Chinese Culture into Opportunity

Driven by national pride and consumer recognition, Chinese domestic brands appeal to the younger generation by their fresh and modern design, being part of the wave of this new consumer-driven economy. Global X China Consumer Brand ETF (2806 HKD / 9806 USD), delivering access to dozens of companies with high exposure to consumption premiumization theme in China, allows you to tap into these growing opportunities of Chinese domestic consumption trends.

THIS ARTICLE IS FOR EDUCATIONAL PURPOSES. NOT FOR SOLICITATION, OFFER OR RECOMMENDATION TO TRADE ANY SECURITIES.