The Emergence of Cloud Gaming

As global internet and cloud computing infrastructure continues to improve, cloud gaming (or Gaming-as-a-Service) has emerged to become a new online gaming format. Traditionally, games run locally on a user’s video game console, personal computer, or mobile device. Playing top-quality games usually requires dedicated hardware with superior computing power and high resolution. Cloud gaming, in contrast, leverages cloud servers to stream video games directly to users’ device, enabling them to game remotely from cloud.

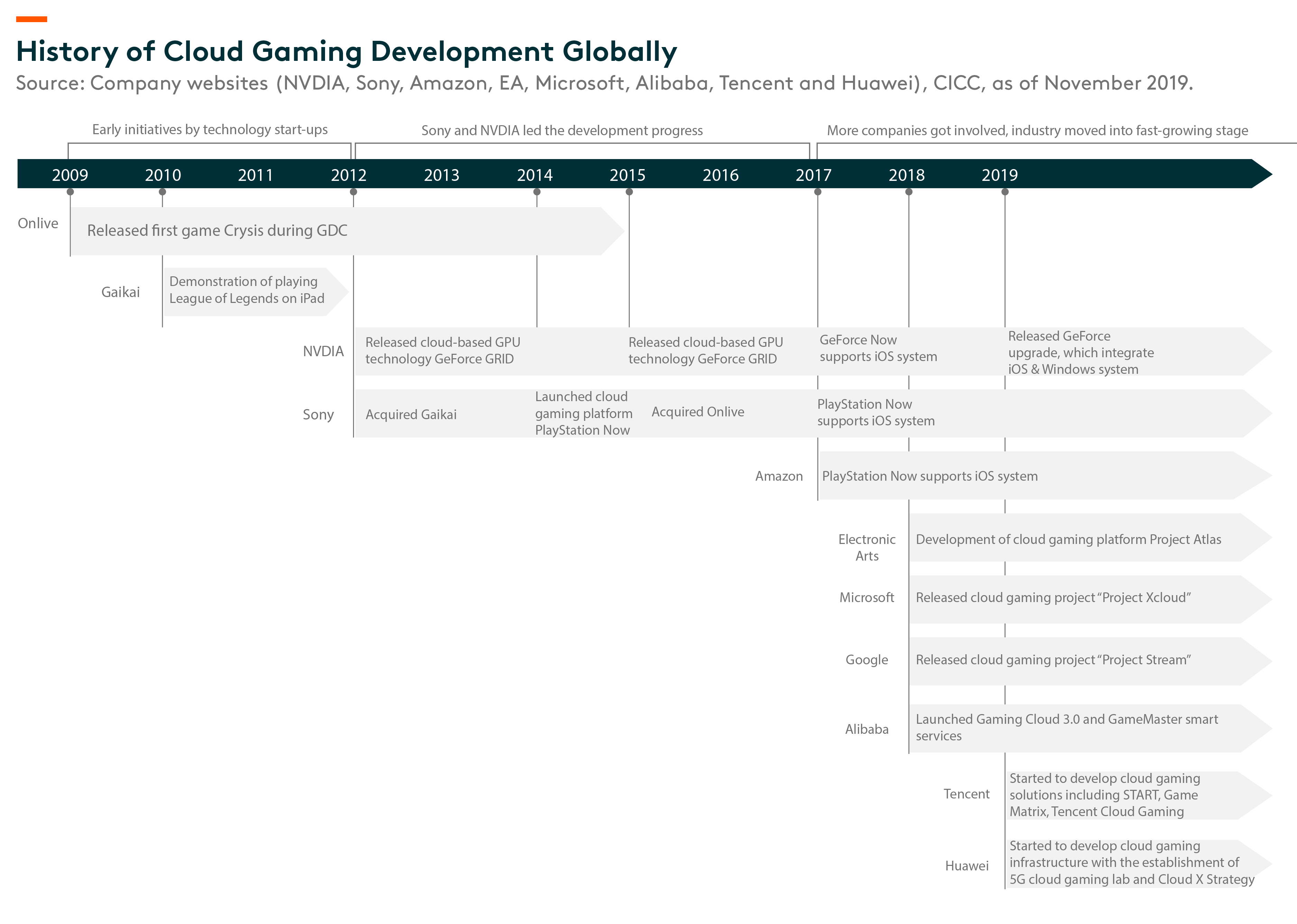

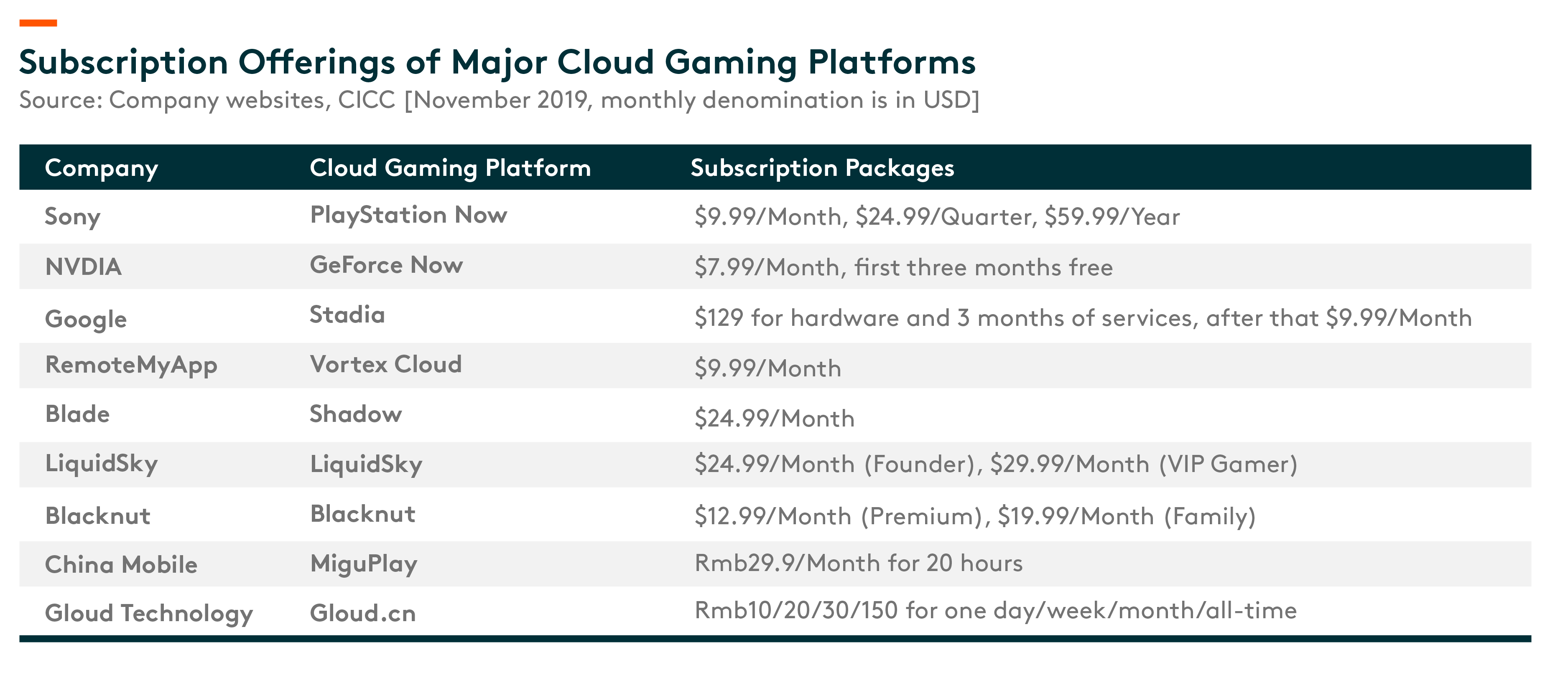

At the Game Developers Conference in 2009, OnLive unveiled its first cloud gaming service. Later during 2012-2015, Sony acquired OnLive and its competitor Gaikai, and released its own cloud gaming platform PlayStation Now. In March 2019, Google released Google Stadia, which allows users to stream games on any device at 4k resolution and at a frame rate of 60 FPS (Frames Per Second). Currently, major online gaming players and GPU (Graphics Processing Unit) producers all have cloud gaming services offering a monthly subscription model. For example, Google Stadia Pro’s monthly subscription is priced at US$9.99/month.

Due to latency and technological hurdles, cloud gaming penetration has been quite gradual over the past years. However, we expect the 5G roll-out to help accelerate user adoption and drive continuous infrastructural improvement. According to Newzoo (Cloud Gaming Report 2020, published in Sep. 2020), cloud gaming is estimated to generate revenues of US$585mn by the end of 2020, with North America and Europe accounting for 39% and 29% of the total revenue, respectively. By 2023E, the cloud gaming market will be worth US$4.8bn but only ~2.5% of total global online gaming market size (Cloud Gaming Report 2020, published in Sep. 2020).

What does it mean for consumers?

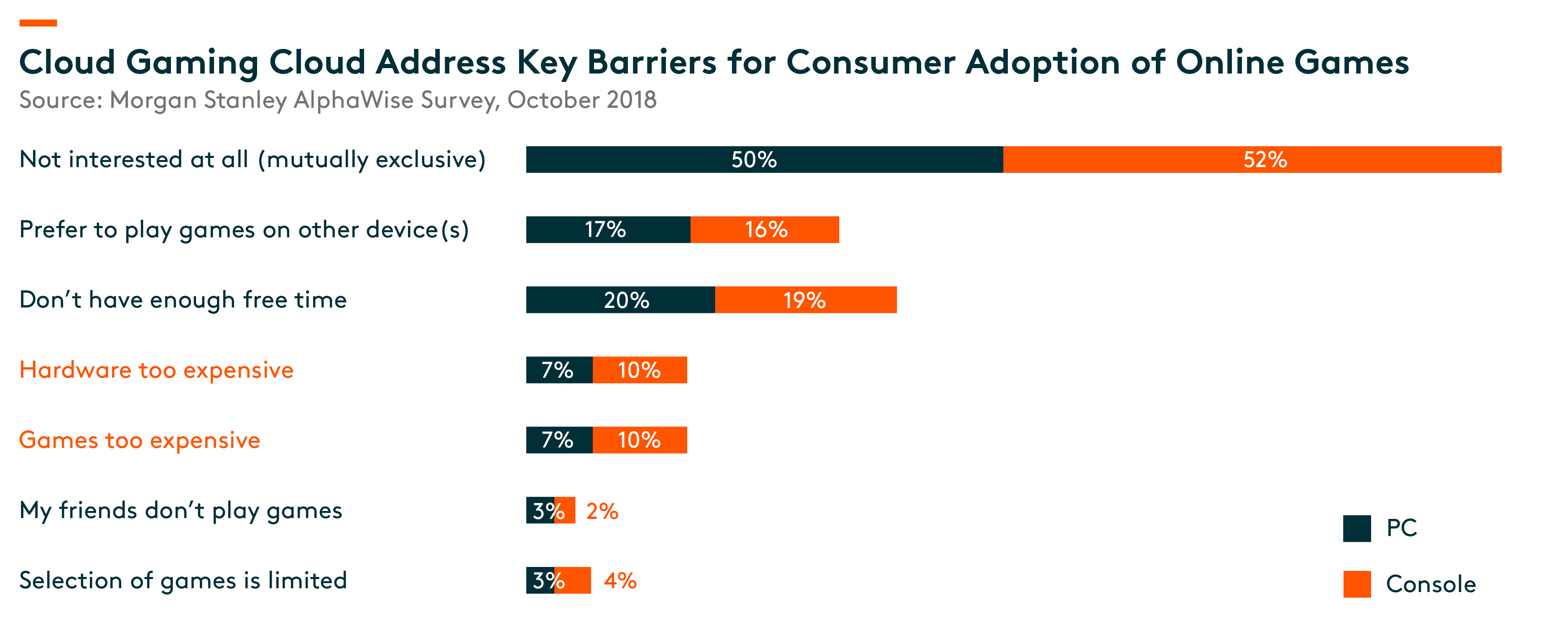

In our view, cloud gaming expands the addressable user base, as it

- lowers the barriers for users to play high-quality games by removing the upfront needs to buy expensive devices (gaming computer price cloud range from US$400-2000, based on our channel checks),

- enables consumers to play on any screen connected to the internet, and

- provides a more diverse gaming portfolio at more affordable prices, under the subscription model, which in our view could potentially also increase paying user base and time spent.

What does this mean for the online gaming industry value chain?

Despite the fact that cloud gaming will continue to be a small niche within the online gaming industry, we believe that it has important implications for the online gaming industry value chain.

In our view, under the subscription model, cloud gaming platforms will continue to purchase high-quality games in order to increase user stickiness and attract new users; a trend observed by major video and music streaming platforms (e.g. Netflix and Spotify). As a result, game developers with strong R&D (Research & Development) capabilities will likely gain higher bargaining power and higher revenue share. This also in turn drives increasing focus on game quality.

In addition, we expect cloud gaming to serve as an incremental channel for publishers, helping them to tap into a broader user base. Game publishers could be more operationally-efficient as cloud gaming doesn’t require in-app downloads like mobile games, which means user acquisition becomes easier in social media, short-form video, livestreaming and other platforms, and cloud gaming platform link can be embedded naturally to those platforms.

Large public cloud providers are also well-positioned to benefit from emergence of cloud gaming, as they have the necessary footprint and technical capabilities to stream games to a global audience. They could potentially charge fees based on usage or revenue share with cloud gaming service platforms, assuming they are not running the services themselves.

Related ETF

Global X China Robotics and AI Brand ETF (2807 HKD / 9807 USD), seeks to deliver the performance of the FactSet China Robotics and artificial Intelligence Index, enabling investors to access to high growth potential through companies critical to the development of robotics and artificial intelligence in China.

Other Key Features of Global X China Robotics and AI ETF:

- Unconstrained Approach: The fund’s composition transcends classic sector and industry classifications by tracking an emerging theme.

- ETF Efficiency: In a single trade, the fund delivers access to dozens of companies with high exposure to the robotics and artificial intelligence theme in China.

Please click here for more information on the Global X China Robotics and AI ETF.