Display Market: Latest Innovations, Drivers, and Trends

In this article, we provide an introduction to the display industry by walking through the key display technologies and examine the current competitive landscape of the industry.

Nature of Display Business

The display industry is highly concentrated due to a few reasons. First, while technology migration is relatively slow, R&D in next-generation technology takes time and requires significant investment. Betting on the wrong technology could have devastating results. Second, panels especially mature technology like LCD(Liquid crystal display) is commoditized, which means limited bargaining power for display producers and price can be volatile. Third, capacity expansion is capital intensive. Total investment for a new LCD factory is around US$10-20bn. (Beijing Oriental Electronics BOE 2019).

Display Technology Migration

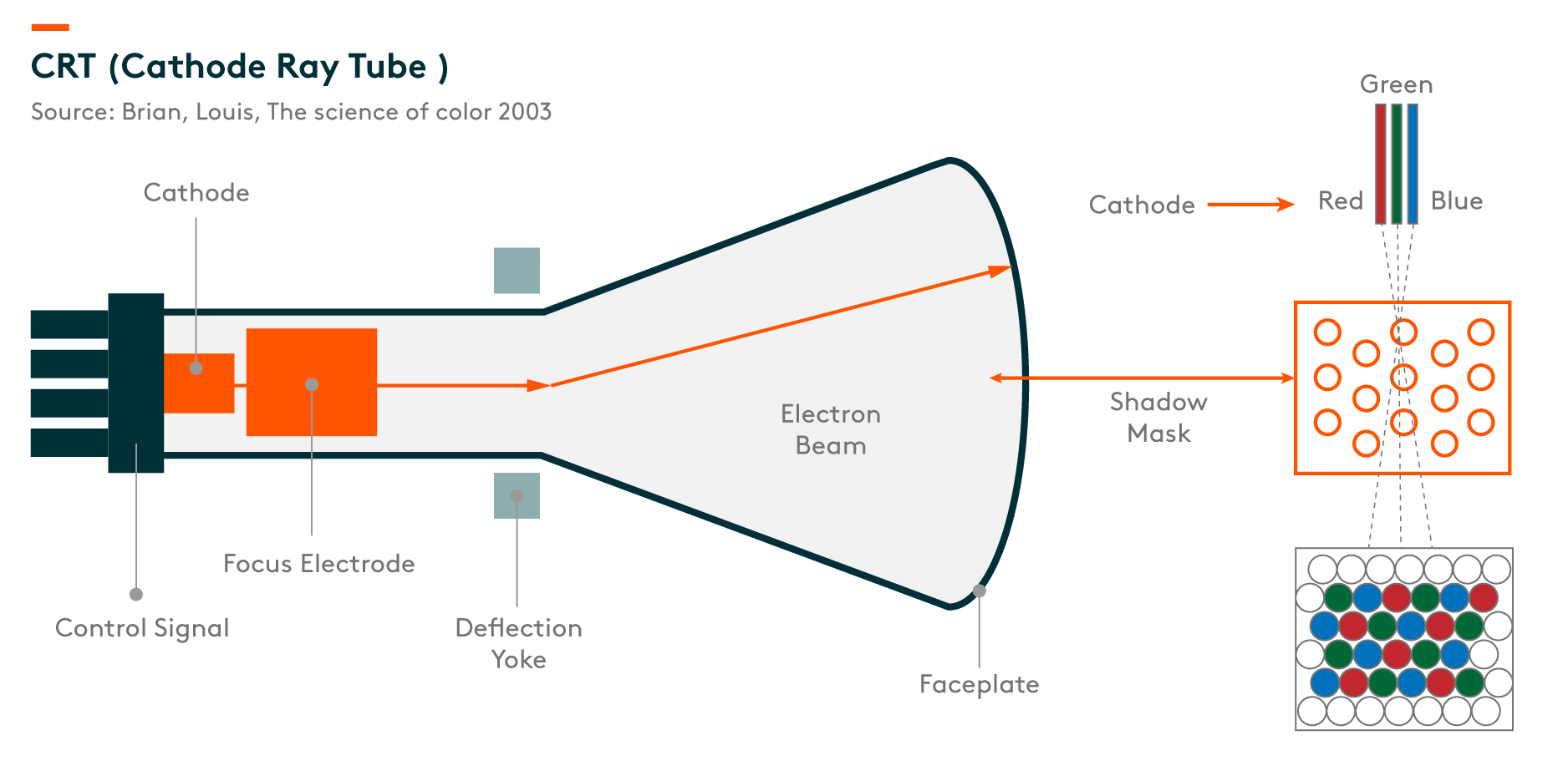

We can trace the root of modern display technology back to research around cathode rays in the 1890s. After decades of research and attempts, by the 1920s prototypes of the earliest television start to emerge. Color television was introduced in the late 1940s; however, the core mechanism behind mainstream display technology remains largely unchanged throughout the 20th century, as TV makers continue to adopt different versions of cathode ray tube design.

CRT (Cathode Ray Tube)

Mechanism: Multiple electron guns housed in a cathode fire electron through the vacuum tube. The deflection angle of the electrons is controlled by the vertical and horizontal deflection coils. When the electrons hit the phosphorescent material on the screen it excites the R, G, and B phosphors which emit light in a process called cathodoluminescence.

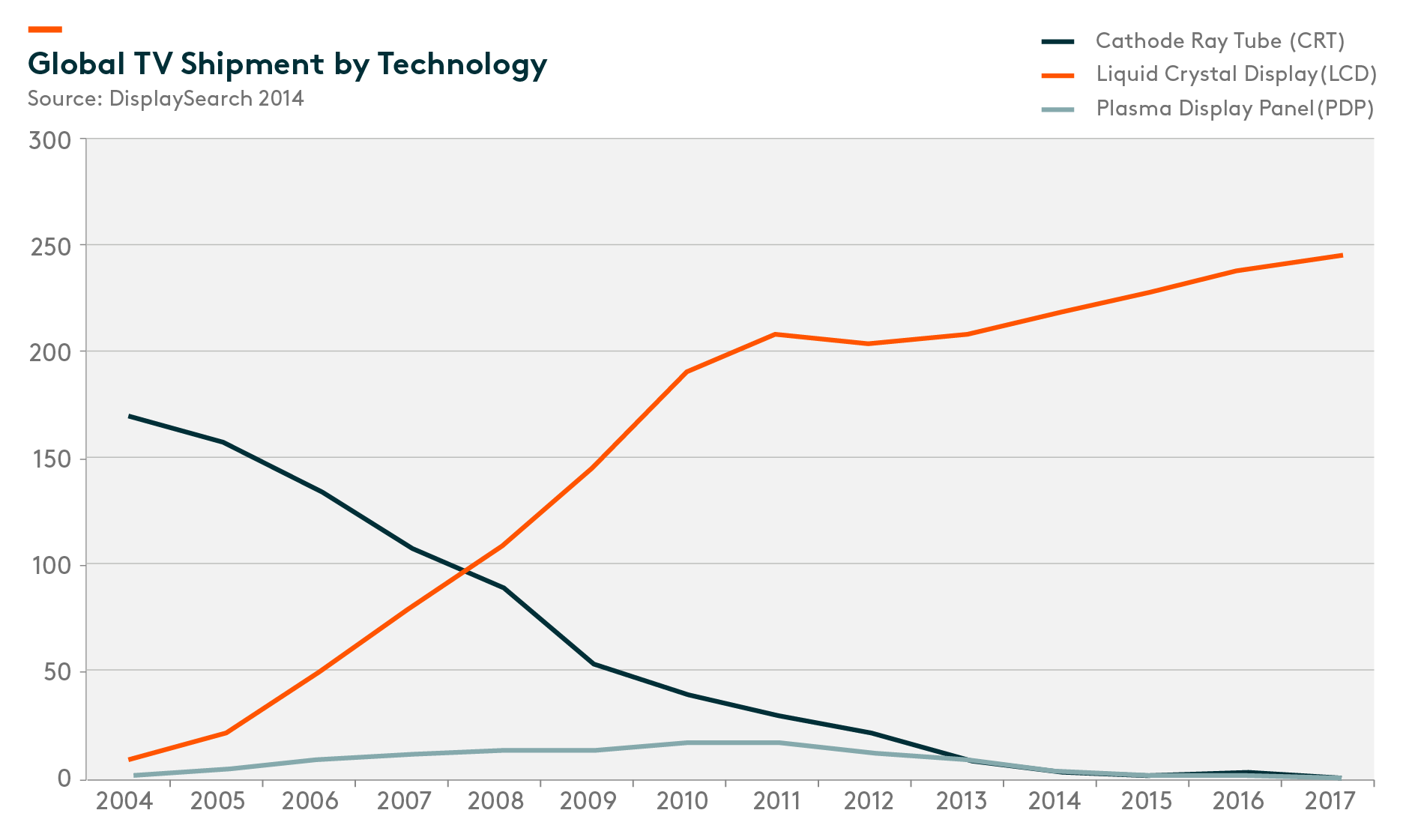

Development: From the 1930s to the 2000s, CRT has been the dominant display technology for television and computer monitors. It is the earliest display design covering the monochrome and color era of television. As other technologies like plasma and LCD enter the market in early 2000, CRT shipment starts to drop significantly. Sony one of the largest makers of CRT TV ended production of cathode-ray tubes in Japan in 2004, then stopped production of all CRT TVs in 2008.

Plasma Display Panel

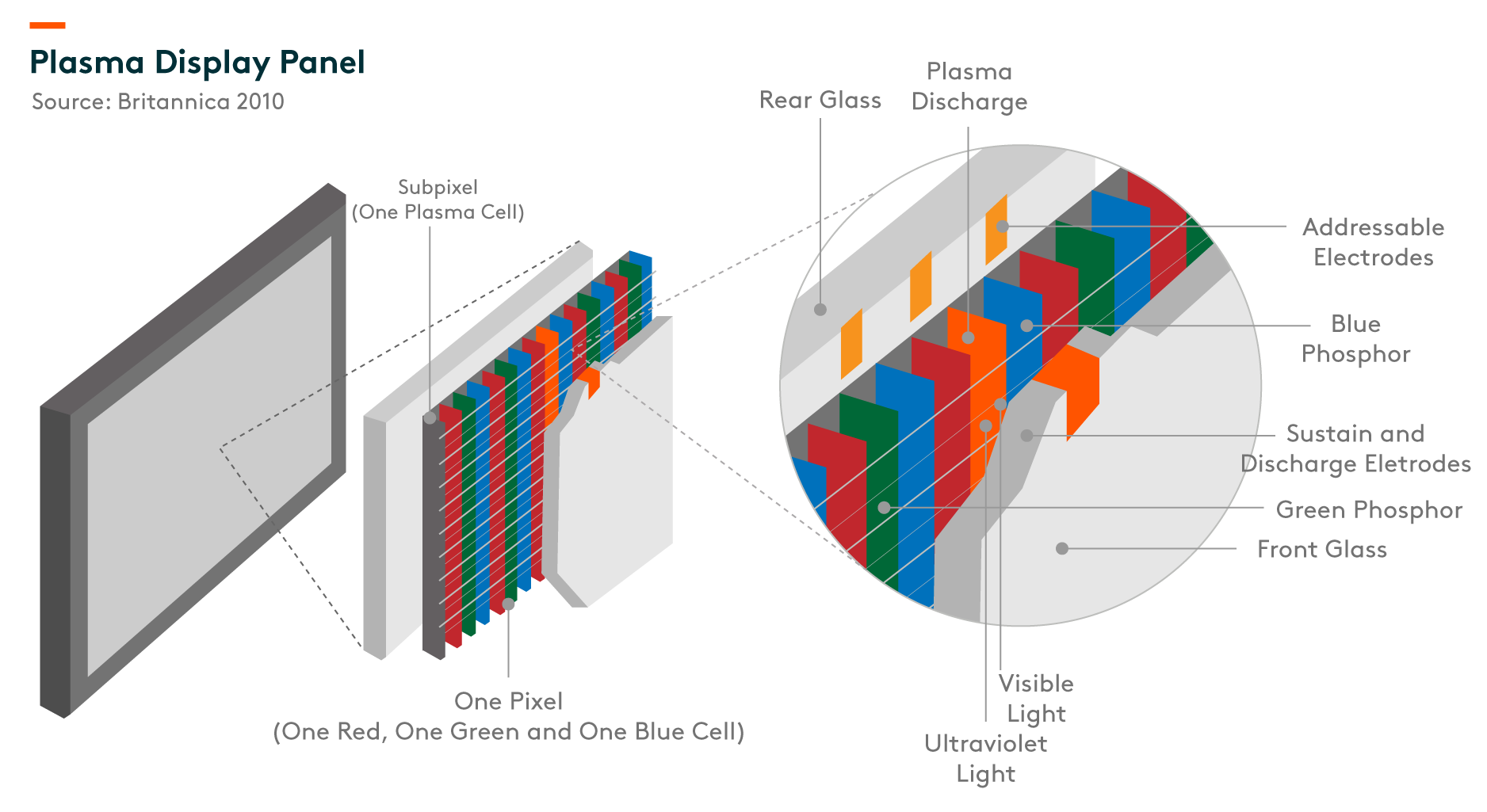

Mechanism: The plasma display panel uses a small cell that contains plasma (ionized gas) between two ultra-thin glasses. A pulse of electricity causes gas sealed in a subpixel to form plasma and discharge ultraviolet light. This discharge in turn causes the phosphor coating of the subpixel to flash visible light through the front glass panel.

Development: Panasonic was the leader behind this technology. In early 2000 Plasma was the popular choice for premium large panel size TV as LCD and CRT TV size was limited at the time. However screen burn-in has always been a problem for the technology, Panasonic’s monopoly power in the technology also forces other panel makers to seek alternative technologies. As a result the technology never became a mainstream display solution. By the early 2010s, large-size LCD prices and performance squeeze plasma display panel out of the market. Panasonic ended production of plasma TV in December 2013.

LCD (liquid crystal display)

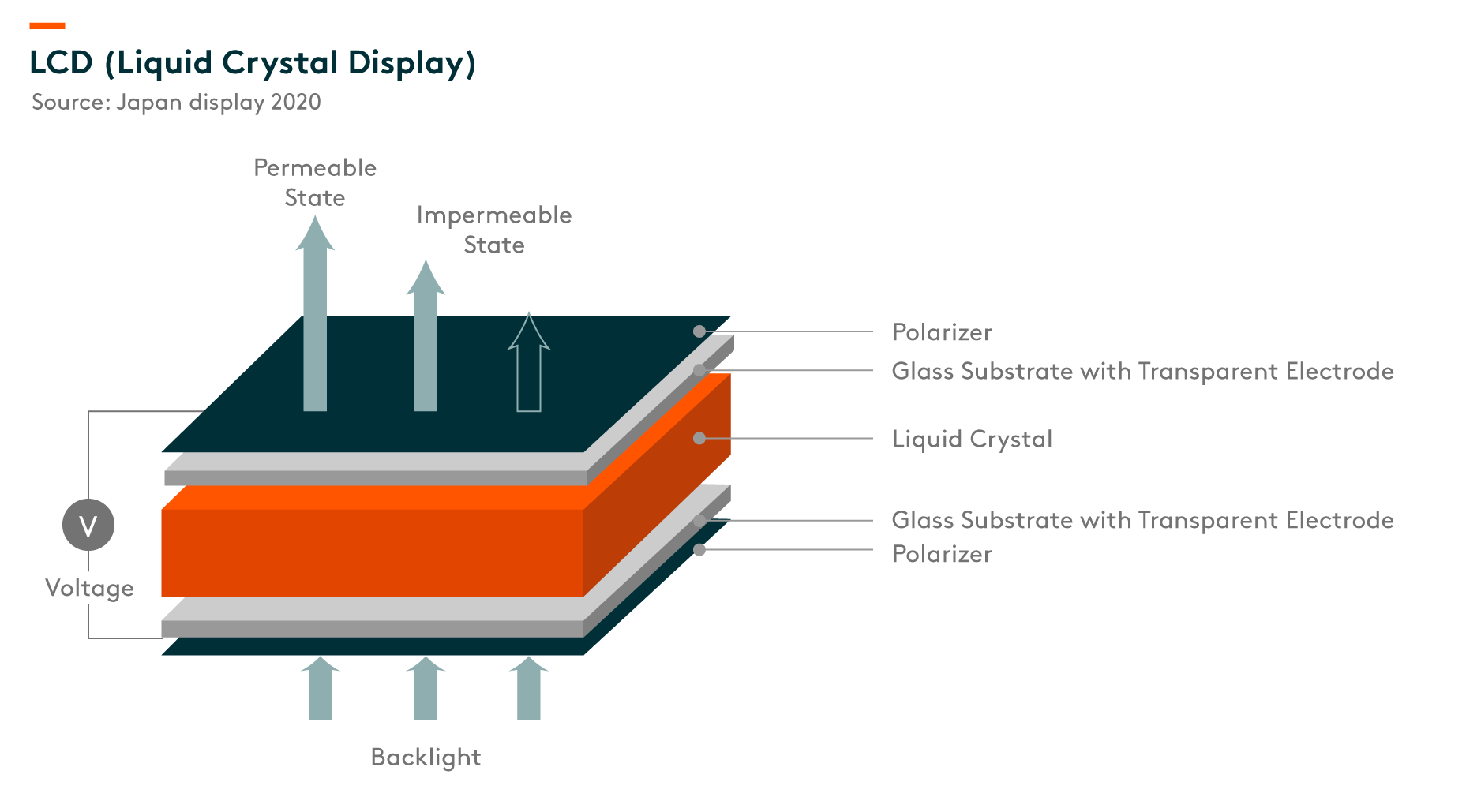

Mechanism: LCDs are lit by a backlight, and pixels are switched on and off electronically while using liquid crystals to rotate polarized light.

Development: LCD was the main display technology to replace CRT and still dominates the display market today. The technology has been able to evolve to stay competitive as it continues to improve in resolution, contract, the power consumption etc. The latest variation includes quantum dot LCD and mini LED backlight LCD.

OLED (Organic light-emitting diode)

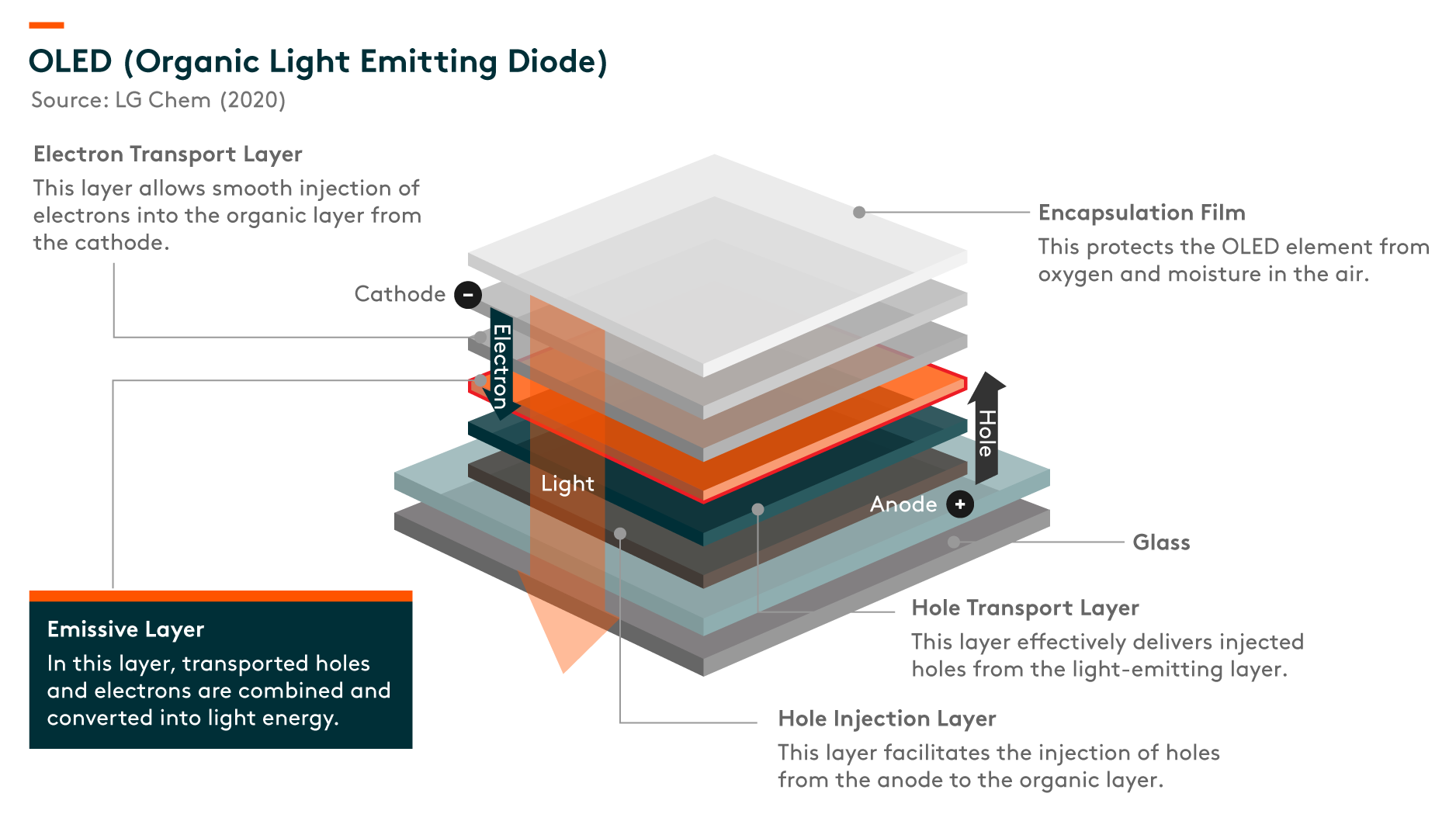

Mechanism: OLED works by placing a series of organic thin films between two conductors. When a current is applied, the organic compound emits light. The two main types of OLED are Active-matrix OLED and Passive matrix OLED.

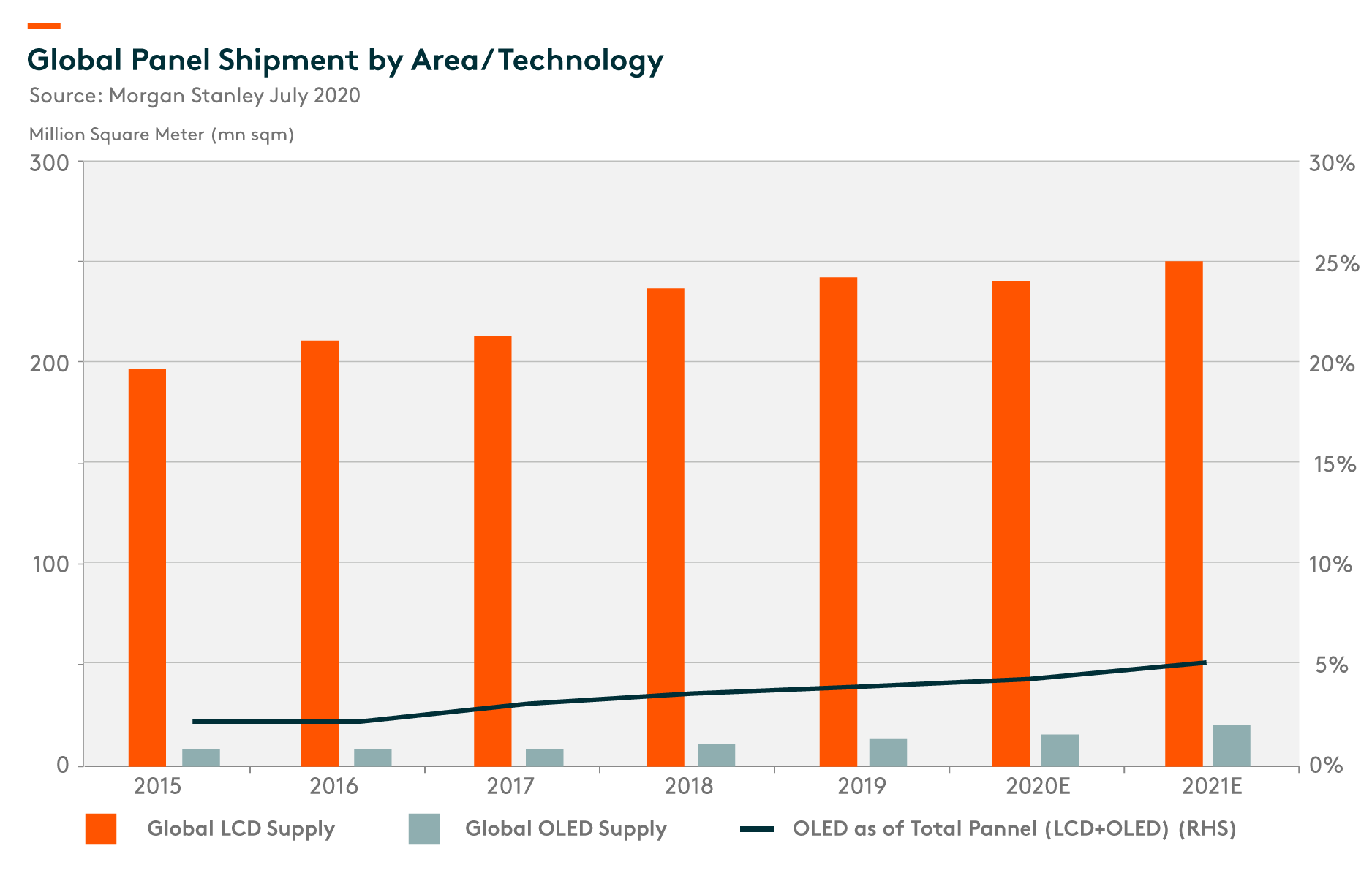

Development: Practical OLED prototypes appeared in the late 1980s. Companies start to make small volume of commercial OLED displays in the early 2000s. OLED provides pixel-level brightness control as it does not rely on backlights. It provides better contrast, higher brightness, and lower power consumption compared to LCD. However, due to the significantly higher cost relative to LED, penetration of OLED is still under 5% of global panel shipment by area in 2020(Morgan Stanley 2020). OLED is mostly adopted in devices with a smaller display such as smartphones and wearable products.

Rise of Chinese Panel Makers

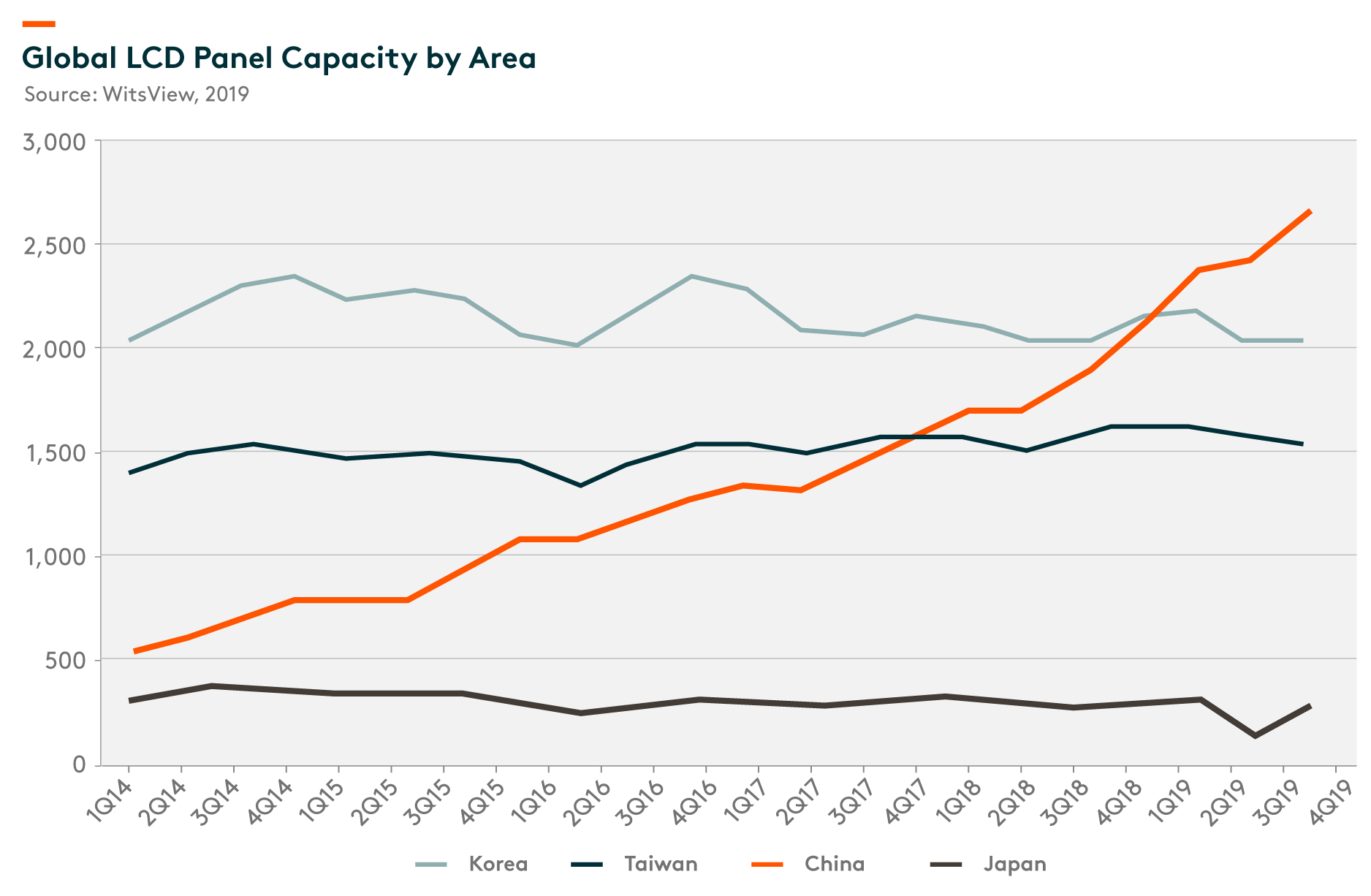

Korea and Taiwan once controlled the LCD market, and for many years China imported a significant amount of displays. In 2010, the display panel was the fourth largest import by value among all the imported goods in China. However, China has picked up the pace of LED manufacturing. In 4Q18, China’s LCD production capacity surpassed South Korea, being the largest in the world. China is estimated to account for around 40% of global LCD capacity in 2020 and is expected to continue to gain more market share. (DSCC Display Supply Chain Consultant, 2020) On the other hand, Korean LCD panel makers are planning to exit the market, as excess capacity and strong competition have impacted their profitability in LCD production. Three main Korean LCD production lines will be closed in 2020/2021, which is around 5.7m sqm/quarter of their capacity or around 30% of the total capacity from Korea. (Morgan Stanley 2020)

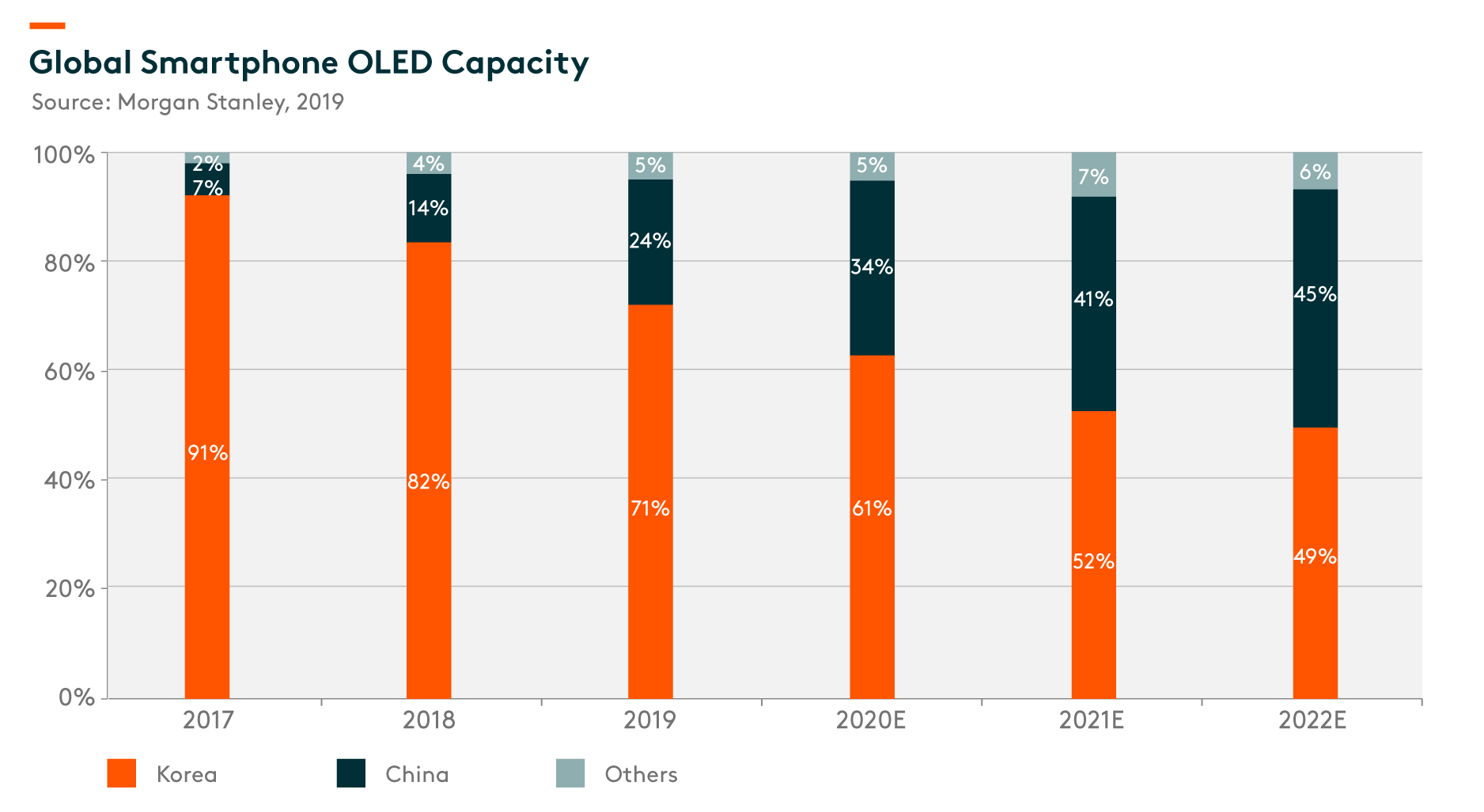

In addition, China is stepping up its effort to tap into the OLED market, which is dominated by Korean companies. BOE (Beijing Oriental Electronics)started to invest in OLED back in 2012, the Chengdu fab alone required RMB 46.5bn of investment. (BOE 2013) Morgan Stanley estimate China accounts for around 28% of global OLED capacity in 2020 and will be on track to reach 45% of global OLED capacity in 2022.

Industry outlook

The exit of Korean players in LCD will stabilize the panel price going forward. We believe innovation is the key growth driver for the industry as new technologies such as quantum dot, micro LED and mini LED continue to improve display performance.

Related ETF

Global X China Semiconductor ETF enables investors to access high growth potential through companies critical to the development of semiconductors in China.

Other Key Features:

- Targeted Exposure: The fund delivers targeted exposure to an emerging theme and industry.

- ETF Efficiency: In a single trade, the fund delivers access to dozens of companies with high exposure to the semiconductor theme in China.

Please click here for more information on the Global X China Semiconductor ETF.