Chinese Vaccine Industry Research Series III

China’s Vaccine Market Dynamics

In our ‘Introduction to vaccine’ piece we discussed different types of vaccines. In this note, we will focus on China’s vaccine market dynamics.

Sizing the Opportunity

China’s vaccine market grew at 6.2% CAGR from RMB19.9bn to RMB25.3bn by 2013-2017, according to “CIC” (China Insights Consultancy), according to CLSA report dated May 10th, 2019. Per CIC forecasts the sector is expected to accelerate to RMB106.5bn in 2030, that is an 11.7% compound annual growth rate (“CAGR”) from 2017.

Meanwhile, the country’s private vaccine sector delivered a faster 14.9% CAGR over 2013-17, when it nearly doubled from RMB12.4bn to RMB21.7bn, according to CLSA report dated May 10th, 2019). CIC, , according to CLSA report dated May 10th, 2019, forecasts that it will reach RMB101.9bn by 2030, representing a 12.7% CAGR from 2017. This will be driven by strengthening R&D capabilities supporting the development of new and innovative vaccines.

Vaccines that Lead in the Global Market

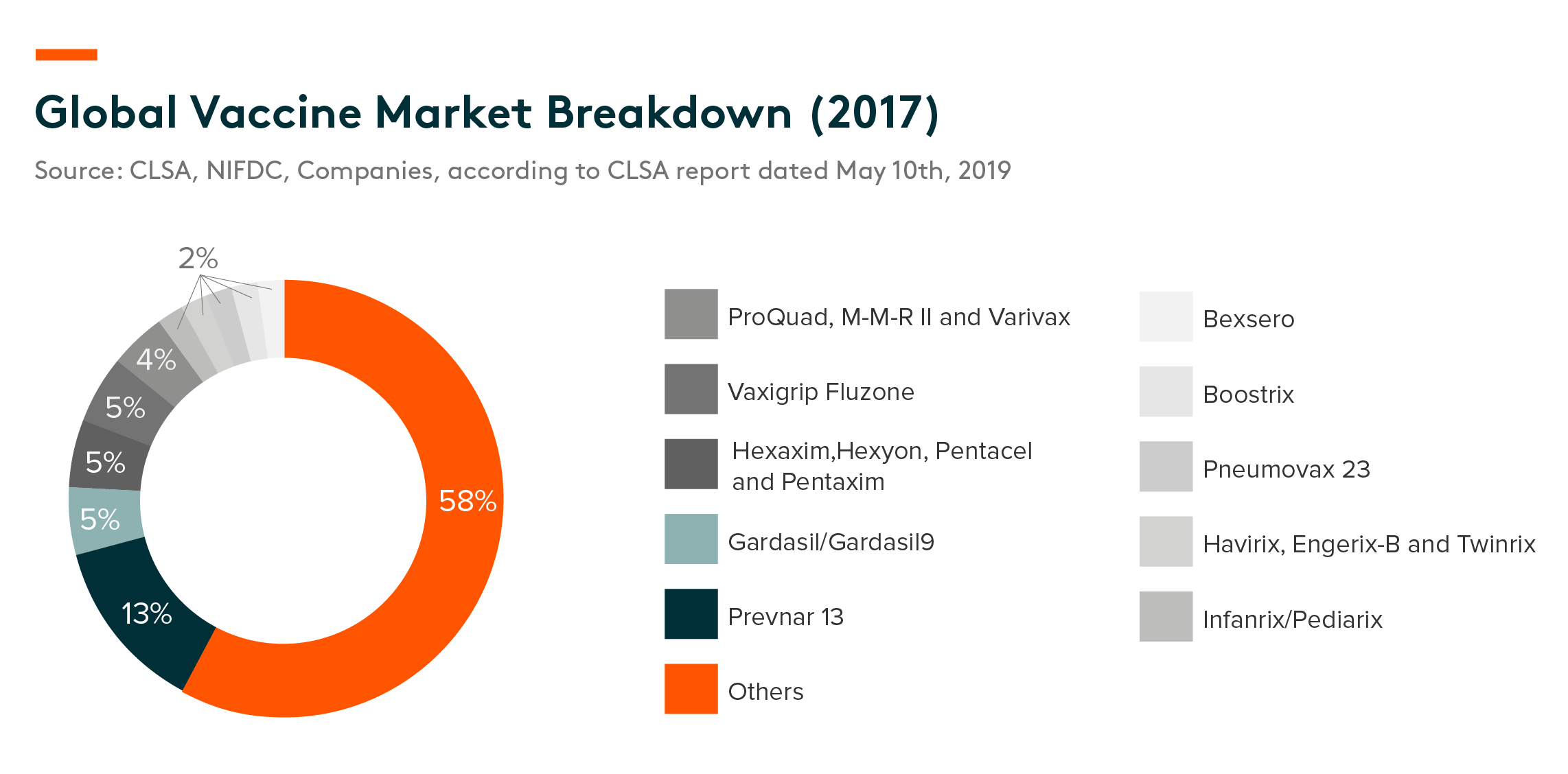

The global vaccine market reached US$43.8bn in 2017, an 8.7% CAGR 2013-17, according to CIC.

Pfizer’s Prevnar 13, a preparation that immunizes against pneumonia, had the largest market share by sales with 13% in 2017. Gardasil/Gardasil 9 (HPV vaccines) ranked second with a combined 5%. Meanwhile Hexaxim, Hexyon, Pentacel and Pentaxim, which help to prevent DTP, Hib and Polio, are made by Sanofi; together they accounted for another 5%.

China Vaccine Market Segmentation

According to the Regulation on the Administration of Circulation and Vaccination of Vaccines issued by the State Council of China, , according to CLSA report dated May 10th, 2019, China’s vaccine market is divided into two categories. Category-1, refers to vaccines that are free of charge to citizens, while category-2, vaccines are paid out-of-pocket by individuals.

Category-1 vaccines are purchased from manufacturers by provincial CDCs (Centre for Disease Control and Prevention) at relatively lower prices compared to category-2 products, and are offered to the public for free. Vaccine prices in the public market is regulated by the government and are generally low, while those distributed in the private market are sold at higher prices and have better margins.

State Owned Enterprises (SOEs) Account for 40% by Volume

Lot-release volume data by China’s National Institutes for Food and Drug Control (NIFDC) show that China’s vaccine market was highly segmented in 2018, with more than 40% controlled by SOEs. There are seven SOEs that provide vaccine products in China.

Category-1 vaccines are mainly supplied by SOEs. Some private-sector players, such as Kangtai Biological and Changsheng Biotech, also manufacture and provide several types of category-1 vaccines. With the further expansion of the national immunization program, we expect more category-2 vaccines to be included in the scheme, with private-sector players’ market share gradually increasing.

We discuss below 3 key sub-segments in China’s vaccine market.

Meningococcal Vaccine Market

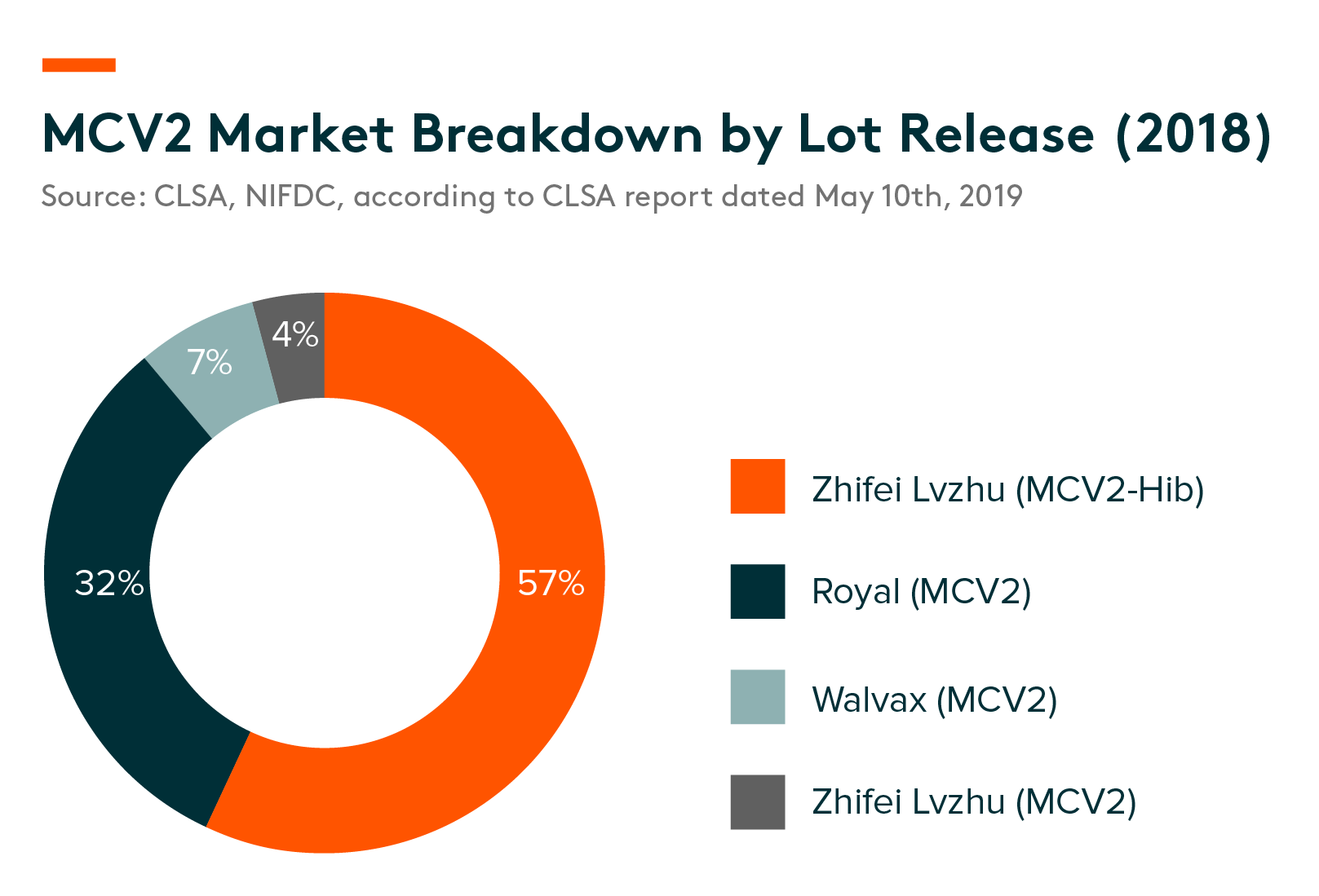

Neisseria meningitides is a bacterium that causes meningitis and other forms of meningococcal disease. There are two main types of meningococcal vaccines: MPSV and MCV (Meningococcal polysaccharide vaccine and Meningococcal vaccine). Both of have bi-valent and quadra-valent versions. MPSV is the primary meningococcal vaccine in China, while MCV2 is the only available meningococcal conjugate vaccine in the country and can only be purchased in the private market. However, in developed countries, MPSV has already been replaced by MCV products and the meningococcal vaccine market is dominated by MCV4 vaccines. MCV4 vaccines, which have broader serogroup coverage, are forecast to gradually replace MCV2 products in China.

The meningococcal vaccine market in China is expected to reach RMB7bn in sales in 2030, from RMB2.1bn in 2017, a 9.9% CAGR, according to CIC, according to CLSA report dated May 10th, 2019. MCV products are expected to be the key growth driver, especially the launch of MCV4 vaccines.

Competitive landscape – There are three marketed MCV2 products and one combination vaccine of MCV2 with Hib in China that are manufactured by Walvax, Royal and Zhifei Lvzhu, as well as four MCV2 candidates are under the development stage. The combination vaccine of MCV2 with Hib from Zhifei Lvzhu dominated the market with a 57% share in 2018, followed by Royal’s MCV2 preparation at 32%.

Pneumococcal Vaccine Market

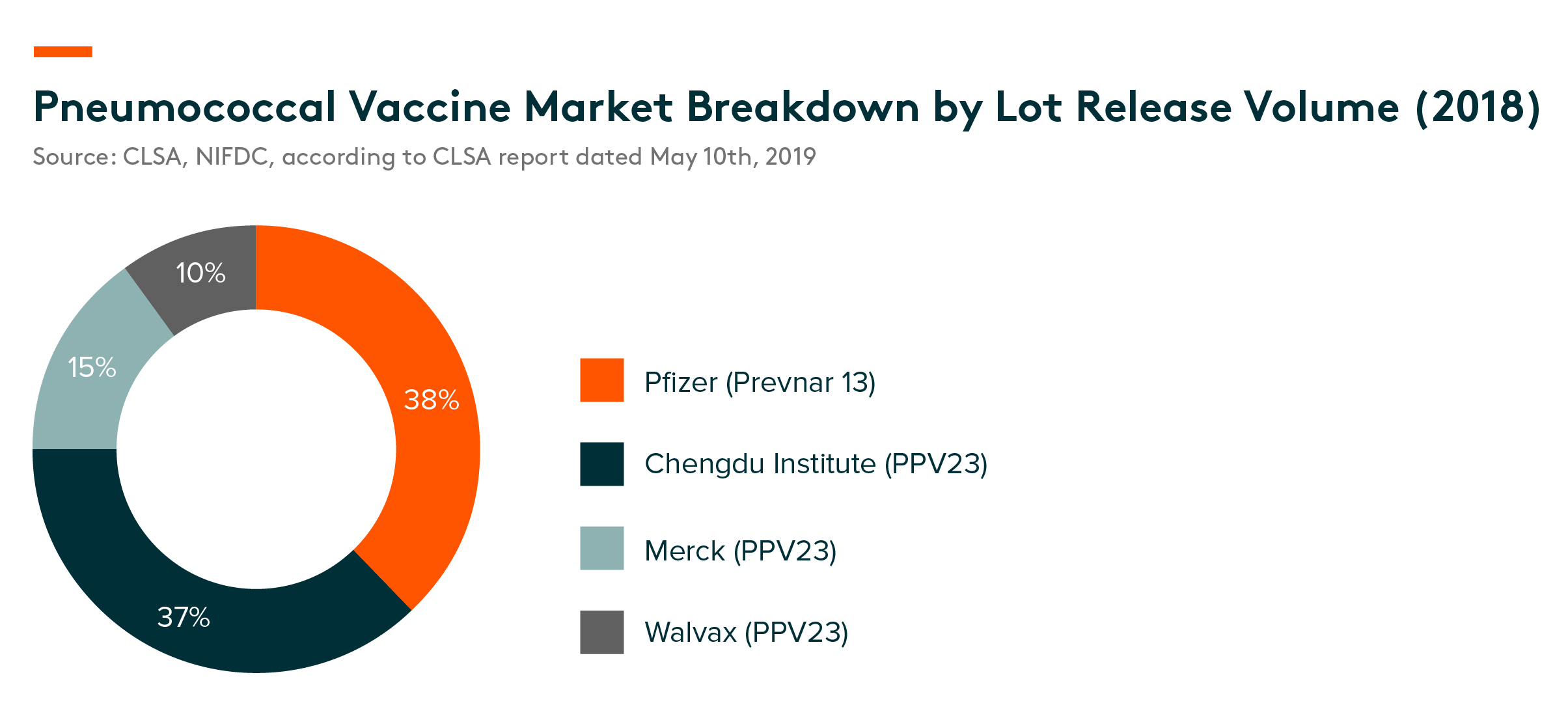

According to CIC, according to CLSA report dated May 10th, 2019, China’s pneumococcal vaccine market recorded RMB1.5bn in sales in 2017. The 23-valent pneumococcal polysaccharide vaccine (PPV23) and 13-valent pneumococcal conjugate vaccine (PCV13) are the two available products domestically for the prevention of pneumococcal diseases. The pneumococcal vaccine market is expected to reach RMB14.6bnin 2030, a 19.7% CAGR 2017-2030, according to CIC(c).

Competitive landscape – Pfizer’s Prevnar 13 was the biggest-single player in the pneumococcal vaccine market in 2018 with a 38% market share, closely followed by Chengdu Institute, an SOE company, with 37%, Walvax (15%) and Merck (10%), according to lot-release data provided by NIFDC. There are also several PCV13 candidates that are under different development stages.

DTP (Diphtheria, Tetanus and Pertussis) Vaccine Market

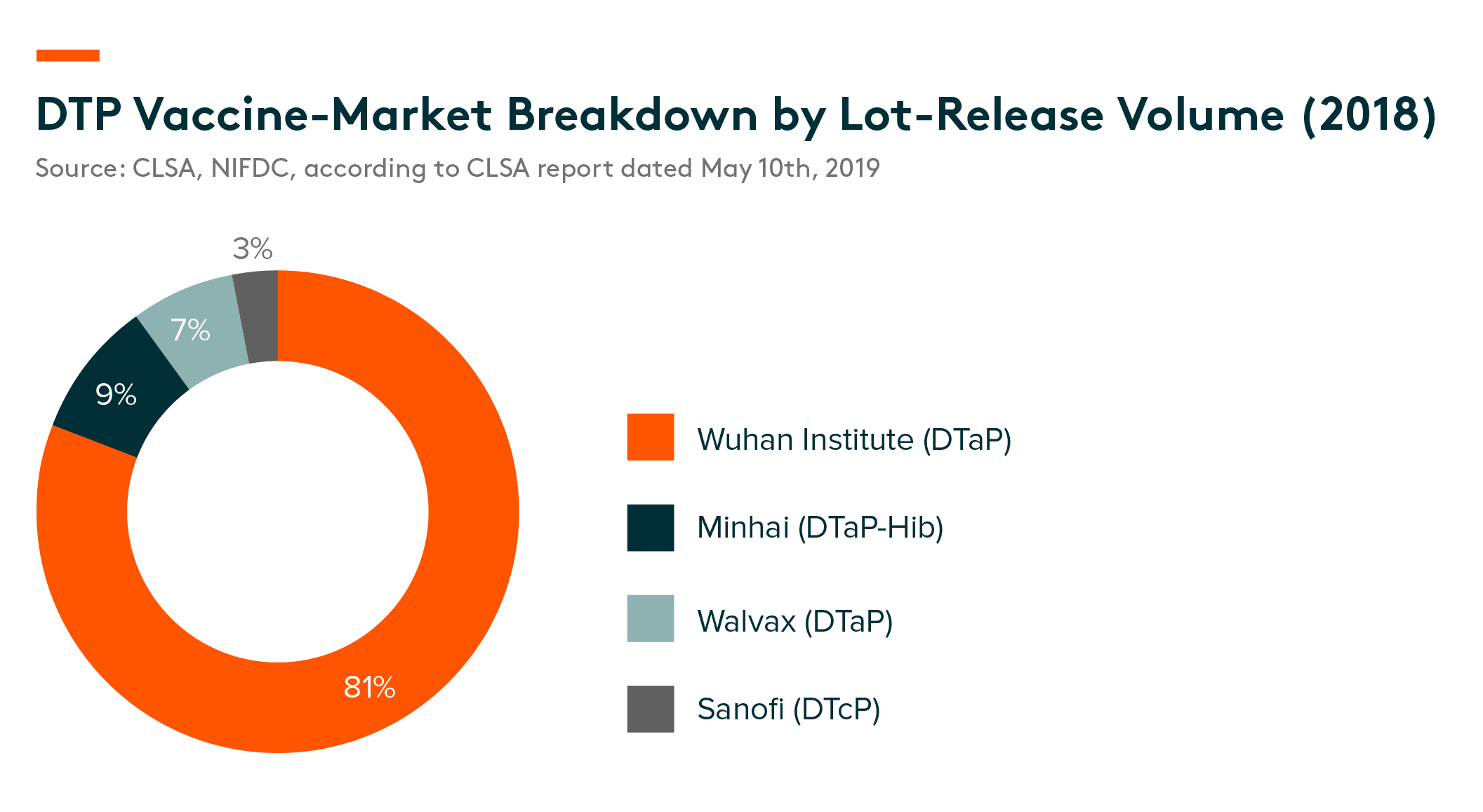

In China’s DTP vaccine market, co-purified DTaP and DTcP (Diphtheria, Tetanus, Pertussis) vaccines are the two main types of preparations.

The DTP vaccine market in China is expected to reach RMB 8.6bnin 2030 (from RMB1.9bn in 2017), a 12.6% CAGR.

Given that DTcP is a key backbone component of a combination of vaccines and there is an emerging trend of increasing development of combination preparations in the industry, according to CanSino Bio (“CanSino”), DTcP, the DTcP-based combination vaccine in China is expected to gradually replace co-purified DTaP in the coming years.

Competitive landscape – According to lot-release data provided by NIFDC, in DTP vaccine market in China, DTaP products in total accounted for 97% of market share. DTaP vaccines from Wuhan Institute, which is an SOE company, dominated the sector with an 81% market share. DTaP-Hib from Minhai and DTaP from Walvax accounted for 9% and 7% of the market in 2017, respectively. CanSino and Beijing Bio-Institute are the only two developers who have DTcP vaccine candidates and both have received clinical-trial application (CTA) approval. In addition, CanSino also has a booster schedule for children four-to-six years old, along with adolescents and adults, according to CLSA report dated May 10th, 2019.

Domestic vaccine companies have a strong understanding of China’s unique vaccine distribution supply chain; this acts as a barrier of entry for new entrants.

Related ETF

Global X China Biotech ETF seeks to provide investment results that closely correspond to the performance of the Solactive China Biotech Index NTR, offering an access high growth potential through companies critical to the development of biotechnology in China.

Other Features

Targeted Exposure: The fund delivers targeted exposure to an emerging theme and industry.

ETF Efficiency: In a single trade, the fund delivers access to dozens of companies with high exposure to the biotech theme in China.

Click here to learn more about our Global X China Biotech ETF.