Sun on the Horizon: the Middle East’s Solar Aspirations

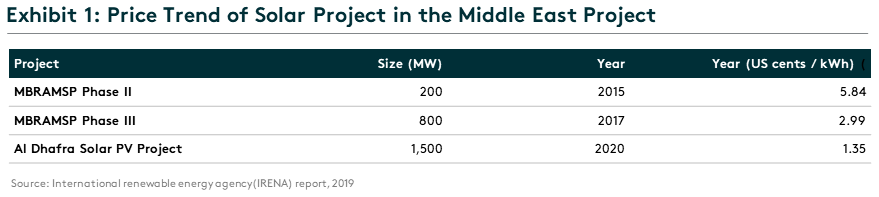

It was astonishing to see the world’s lowest tariff for a solar power plant in the Al Dhafra Region of the UAE recently. Abu Dhabi Power Corporation says it has received a bid of just 1.35 US cents per kilowatt-hour for the project, which is dramatically less than one-third of the projects built five years ago in the same area.

China overall accounts for over 70%1 of the module supply in the major solar projects of the Middle East region. As one of the world’s most attractive solar markets, the cost-competitiveness of the Al Dhafra Region, lowering the power costs and driving the demands, indicates that the upstream Chinese supply chain will be beneficial. In this article, we would like to explore the aggressive price strategy of the solar project in the Middle East region, its implications for other countries, and how China can benefit from these developments.

Low Cost, High Quality

The lowest levelized cost of energy (“LCOE”) in solar plant projects of the Middle East markets can be attributed to a number of key factors, including (1) top solar utilization hours in the world; and (2) low soft cost inland, financing, labor, and tax.

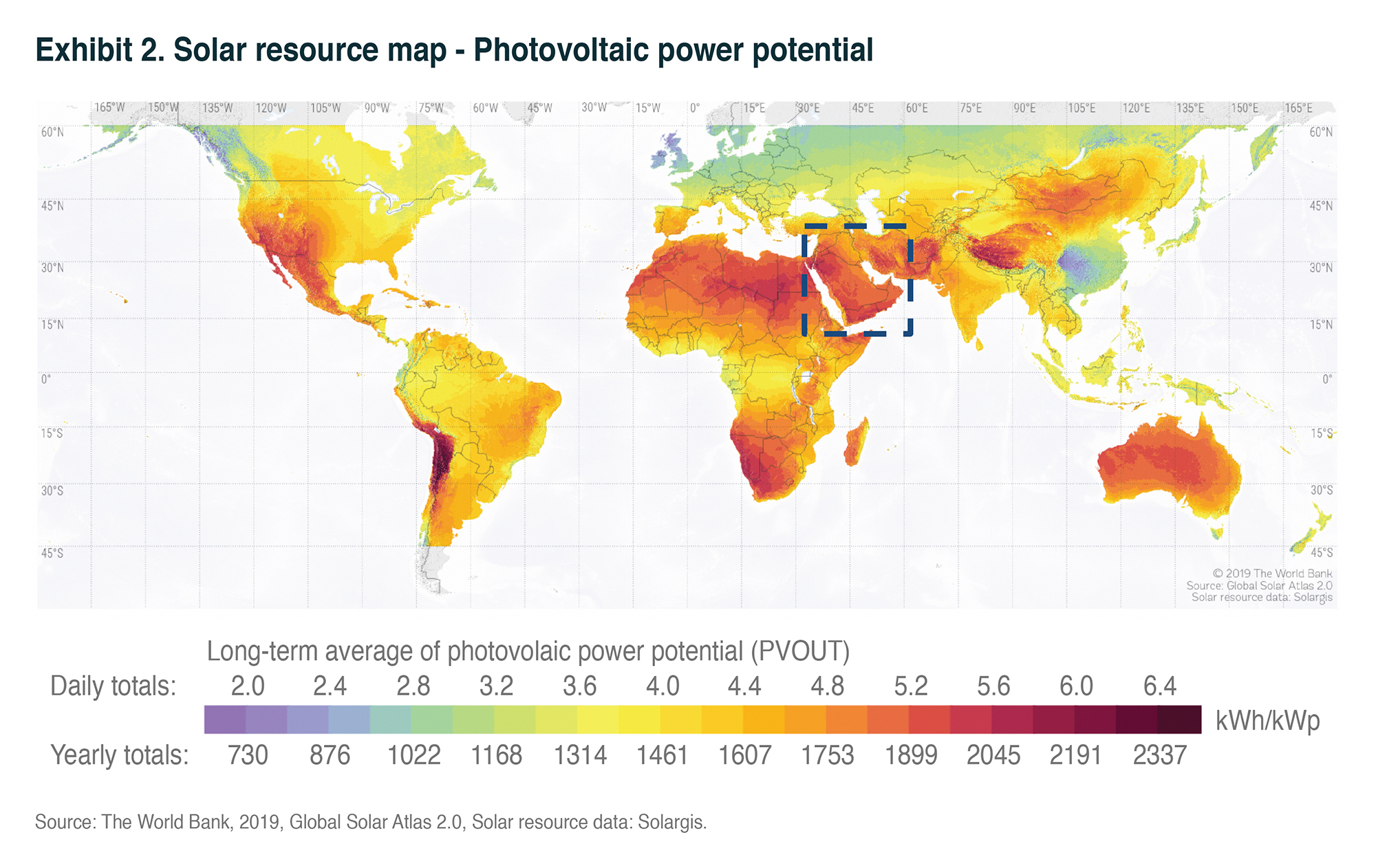

- Top Solar Utilization Hours in the World

Citing Exhibit 1, the Middle East area is home to excellent solar resources, particularly in the Northwestern and Central regions of Saudi Arabia and the Southwestern part of Oman. The UAE, Bahrain, Kuwait, and Qatar also have excellent annual average irradiation. Currently, the UAE’s yearly irradiation can achieve 2,200 kWh per square meter, which is almost twice that of most of Europe and China east coastline, accordingly Exhibit 2. It helps with the lowest-cost solar LCOE without subsidies. - Soft-cost Benefits

Middle Eastern countries are not only blessed with substantial solar energy resources, but also have substantial land reserves to tap that resource. Large swathes of desert land with few trees or vegetation provide near-lossless solar radiation for solar modules, which allows authorities to plan some of the largest solar power projects in the world. In the UAE, for example, the Dubai Electricity & Water Authority has planned a 5 GW solar power park while the Abu Dhabi Electricity & Water Authority is working on a 1.17 GW solar power park.1 It appears that developers did not have to account for land costs that could be around US$5,000 per acre in the US, and the entire land-related cost could be 2/3 of the US1.

Moreover, Middle Eastern countries have reduced their lending rates sharply since the economic slowdown in 2008. The Saudi Arabian Monetary Authority reduced the lending rate from 5.5% to 2.0% in a matter of just four months between October 2008 and January 2009; the lending rate has remained constant at 2% since then. The UAE also cut interest rates during the 2008 financial crisis from 4.75% to 1% and maintained a low rate for a long time. As the market matures and regional commercial banks gain experience with renewable energy projects, debt conditions are becoming more attractive. As renewable energy in the region is generally receiving loans with long loan tenors over 20 years, high debt-to-equity ratios ranging between 70% and 86%, and low-interest rates between 120 and 200 bps plus libor2, which are very competitive with utility-scale solar projects being developed around the world.

The average hourly labor cost in manufacturing in the Middle East area is $5 vs. West and North Europe of $40+, the rest of Europe $10-20, North America $26, Australia $20, South America $1.8-6, China $5.4, India $3.4 and South-Eastern Asia $1.1-2.5.3 It is quite competitive against most areas in the world. What is more? Middle East countries offer tax discounts to attract solar project installation. For example, no sales tax is imposed on solar projects in the UAE vs. 5% in the US and UK.

Unique or Ordinary?

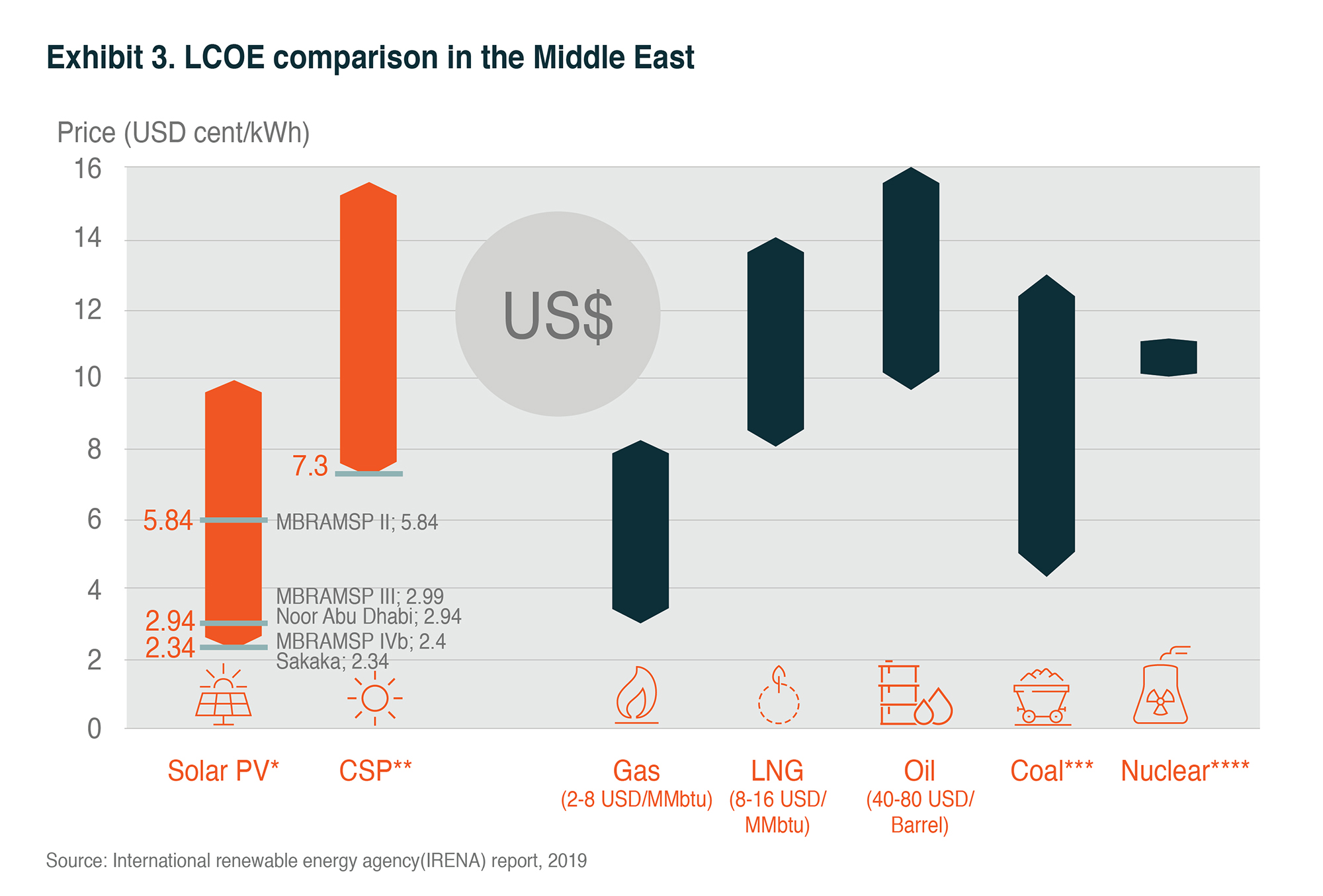

We could see from Exhibit 3 that photovoltaic projects are very competitive in the cost side, compared with electricity generation from oil, nuclear energy, and coal in the Middle East region. Solar energy has achieved customer side grid-parity in most places in the world and got cost side grid-parity in some areas with good solar resources or high power costs, such as India and Mexico.

Technology innovation pushes the module cost down fast in the past ten years, and it is expected to continue in the future. Citing Exhibit 1, the better the region is home to solar resources, the lower solar power cost it has with everything else the same. One example is Spain and Portugal, which are more active in solar installation than North Europe as the Iberian Peninsula has great solar irradiation. We expect the regions with yearly irradiation over 1,400 kWh per square meter4 are more likely first to achieve cost side grid-parity or accelerate solar installation. Some regions with good solar resources also have low-priced hydropower, such as South America and Australia; they have incentives to add solar farms, even not cost side grid parity.

Other than manufacturing cost, balance-of-system (“BoS”) cost accounts for the other half of the total cost, in which soft cost (land and financing cost) takes up a large percentage. Cutting soft costs will significantly help reduce LCOE. For example, commercial banks in China ask for an average 8% loan interest rate to fund a privately-owned solar farm, but only 4% for state-owned enterprises (“SOE”). Thus, the government is pushing SOEs to take over the existing solar farms, which will cut the financing cost by half, with everything remaining unchanged. Chinese central government and the solar industry are also talking about reducing the land cost, especially the wasteland that used to be of no value, but local government sells to solar farm operators for fiscal purposes.

Evolving Solar Ties between China and the Middle East

Being the world’s biggest manufacturer of photovoltaic products and dominating the solar equipment production of the Middle East, China takes advantage of the low-cost and high demands of the downstream developments in solar power. The cost-competitiveness of Abu Dhabi’s solar development is a push factor, driving the growth of the Chinese photovoltaic markets in the foreseeable future.

Global X China Clean Energy ETF, representing the high growth potential through companies critical to further advances and increased adoption of clean energy in China, could be your right choice to capture the evolving opportunities of the solar industry.